Negative electricity prices explained

Why do negative prices occur?

The wholesale electricity price is set every five minutes based on supply and demand. Generators (such as solar farms or coal-fired power plants) make offers to the Australian Energy Market Operator (AEMO) to supply customers and AEMO will create a ‘bid-stack’ that compares these offers.

AEMO will dispatch generation to meet supply based on these offers – the cheapest offers through to the marginal offer are accepted, and those generators are dispatched. The cheapest generation offers in the bid stack are typically offered at a negative price.

While this seems unusual – a generator offering to pay to generate – generators do so to guarantee dispatch knowing that AEMO will dispatch the generators with the lowest price first. However, in most instances, these generators receive a positive wholesale price because the price paid to all generators is set by the offer of the marginal generator – the price of most expensive generator needed to make sure there’s enough supply dispatched to meet consumer demand.

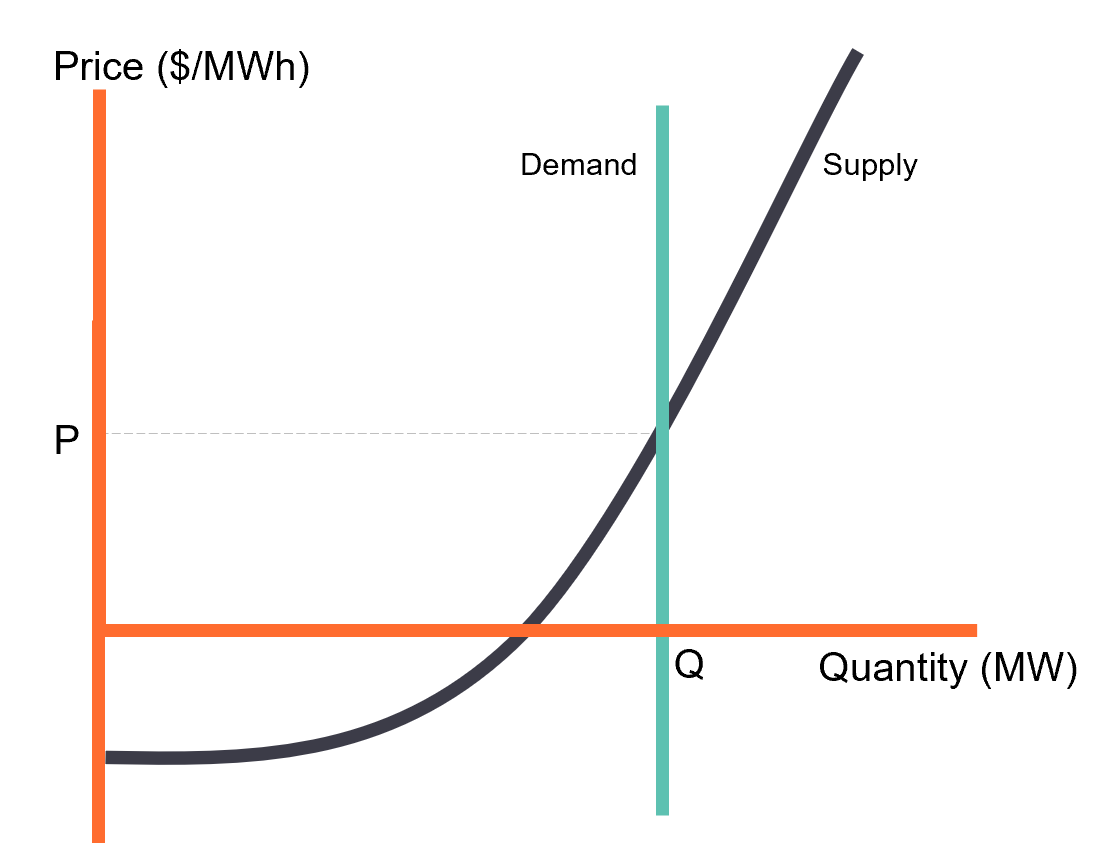

The diagram below shows how the wholesale price is set by where demand for electricity intersects the offers made by generators.

Normally, the price is set based on the cost of operating different types of generation, such as the cost of running a coal-fired power station or a gas plant.

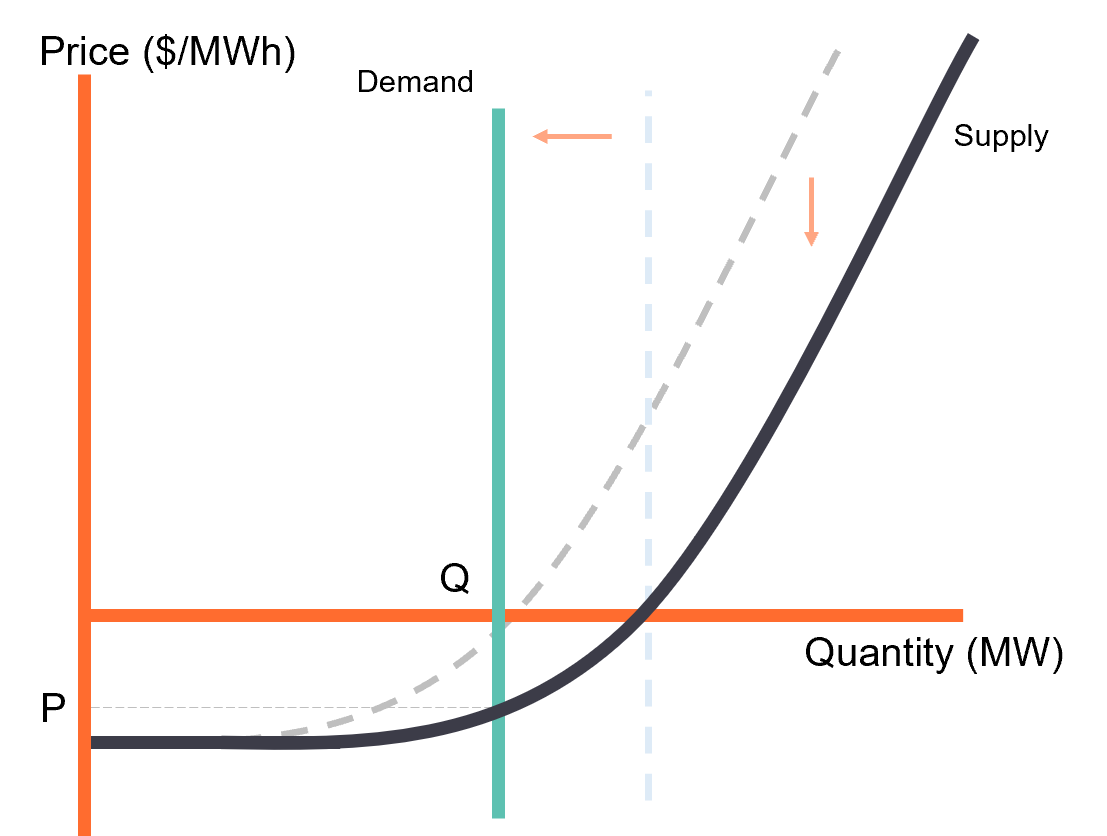

However, with more renewables connecting to the system, we’re seeing more instances of the marginal generation offer being a negative price, causing the wholesale price to be negative. This happens both because of reduced demand (driven in large part by more rooftop PV), and generators offering electricity at negative prices.

The result is a negative wholesale electricity price which means generators pay to generate electricity, and consumers are paid to consume electricity.

Why are negative prices an important feature of the NEM?

Although it seems counterintuitive for generators to pay to generate electricity, and for consumers to be paid to use it, negative pricing helps maintain the balance of supply and demand on the grid.

Negative prices signal when there is too much energy being generated compared to demand. This has two effects – it discourages generators from producing more energy than is required, and it encourages consumers to use more energy when supply is abundant (and typically more renewable).

How often do negative prices occur?

Negative prices were once a rare occurrence, but they’ve become a regular fixture over the past few years. Year on year, the number of five-minute prices that are negative in the NEM continues to climb.

Historically, South Australia has seen most of the negatively priced intervals, but they are now a common occurrence across the entire NEM.

Negative prices occur primarily during business hours, typically corresponding with increased renewable generation during the day from solar – a key driver of the low prices.

How do negatively priced intervals impact overall energy prices?

Negative prices are now so frequent and significant that they are pushing the time weighted average monthly price lower and lower.

The morning and evening price peaks are becoming much more pronounced, accentuating the price difference between peak-renewable periods with low or negative prices, and the high-priced peak demand periods.

Why do generators continue to generate at negative prices?

There are three main reasons that generators continue to generate when the price falls below zero.

- Turning generators on and off can be a slow, expensive process, particularly for generators like coal-fired power stations. In this instance, it’s more cost-effective to offer the power from the station at a negative price and keep generating, than shutting down and having to later restart the entire plant.

- Generators can earn supplemental revenue streams allowing them to make a net profit, even while selling energy at negative prices. Renewable generators, for example, earn renewable energy certificates for every MWh produced. The revenue from these certificates can be more than enough to offset the negative wholesale prices.

- Generators may also be indifferent to the wholesale price, due to selling generation as hedges or operating with offtake agreements that provide a fixed payment per MWh, regardless of the wholesale price.

Why does my retailer charge me for energy if the wholesale price is negative?

It’s important to note that negative prices only occur within the wholesale electricity market and are not necessarily reflected in the price charged to customers by their electricity retailer.

If your business is locked into a fixed-price contract, you’ll be charged the same rate, regardless of whether the wholesale price is negative or not. This is why many businesses are now choosing wholesale linked contracts, with flexible pricing based on real-time market conditions. This means the associated cost-savings are passed through to your business.

How can my business make the most of negative prices?

If your business can shift energy intensive operations to low price periods, and reduce your energy usage during high price periods, you could actively reduce your electricity bill.

Choosing a contract with wholesale price exposure could benefit your business if you have time-flexible operations, you’re comfortable with month-to-month price variation, and can put an energy strategy in place to mitigate price risk, such as demand response.

We’re here to help.

If you’re an existing Flow Power customer, please reach out to your dedicated account manager.

If you’re not a Flow Power customer, contact our friendly team today.