The third quarter of 2021 was certainly an interesting one for the National Electricity Market (NEM).

There was a period of high prices and price spikes near the start of the quarter and high numbers of negative prices in August and September. If you’d like to learn more about what occurred during these months, we’ve published monthly energy market wrap-ups here, which look at the various potential reasons of the higher prices.

This article explains how wholesale prices are calculated and the significant change to the calculation of prices that started on the 1st of October 2021 due to the new 5-minute settlement.

At Flow Power, we always aim to make energy information simple and accessible for everyone, however, often there are quite complex mechanisms impacting price (such as interconnectors and constraints), which we will discuss in a future article.

In this article you’ll find information about:

- The National Electricity Market, generator bids and the bid stack

- Settlement – how it works now and how it is changing

- How the new settlement system might impact the market and customers

The National Electricity Market, generator bids and creating a bid stack

The National Electricity Market

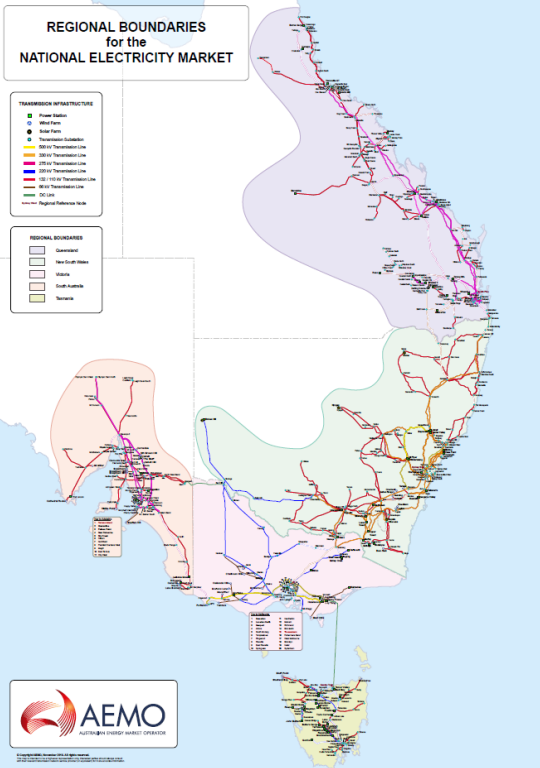

The National Electricity Market (NEM) is the power system and associated markets that connect Queensland, New South Wales, the ACT, Victoria, South Australia and Tasmania. Each state is its own region (except for the ACT, which is counted as part of New South Wales) and has its own spot price for electricity. The image below maps the major network infrastructure of the NEM.

The Australian Energy Market Operator (AEMO) helps manage the collection of payments for power, and the dispatching (organising who generates energy) and paying of generators.

The NEM is an energy only market. This means that generators (such as coal fired power stations or wind farms) are only paid for the electricity they generate. This market structure differs from a capacity market, which exists in Western Australia, and some overseas markets, where generators are paid for energy and for guaranteed level generation capacity.

Electricity is also relatively unique as a commodity in that supply needs to be constantly matched with demand.

There is around 50,000 MW of generation in the NEM, and consumer demand for electricity varies throughout the day. One of the central roles of the NEM is to determine the most efficient combination of generators and storage needed to meet consumer demand for electricity.

Generator bids

Each day, every generator wanting to sell electricity in the NEM must submit a bid, detailing how much energy they would like to offer, with the capacity/volume offered in ten different price bands. These bids are submitted to the AEMO.

Prices can range from the market floor (currently -$1000/MWh) to the market cap (currently $15,000/MWh).

For example, a 1,000MW generator may choose to bid 500MW at $100/MWh, and 300MW at $1,000/MWh, and 200MW at $12,000/MWh.

The price bid by each generator differs based on a number of factors including:

- Costs of operating the generator, such as the cost of burning gas.

- Generators that are more expensive to run will typically offer generation at higher prices. For example, if a coal generator has overheads of $40/MWh of power generated (due to the cost of sourcing fuel), then they may offer most of their power at $40/MWh.

- Generators which do not require fuel (such as solar or wind generators) may choose instead to bid their entire stack at the lowest possible price, in order to be constantly dispatched.

- The costs of turning off. Some generators will offer some of their capacity at negative prices. They do so because it costs them money to turn off inflexible generators, so they would rather stay online, even if prices are low or negative.

- Portfolio positions, such as the level of consumer load. Vertically integrated retailers can operate generators to match the energy consumption of their customers.

Which generators get dispatched? Introducing the bid stack

The AEMO receives all bids at 12:30 PM the previous day. All bids are compiled into a bid stack, which compares bids from all generators and stacks them from cheapest to most expensive.

Dispatch intervals are five minutes long and generators are dispatched for each dispatch interval based on the bid-stack. AEMO calculates how much generation is needed to meet demand and generators are dispatched from cheapest to most expensive.

For example, if Generator A had a bid of 1000MW at $100/MWh, Generator B bid 500 MW at $200/MWh, Generator C bid 3000MW at $300/MWh, and Generator D bid 500MW at $5,000MWh, a demand of 3,000MW would dispatch all of A’s bid, all of B’s bid, and 1500MW of C’s bid.

In practice, the dispatching of generators must also take into account a range of other variables including ramp up/down capacity, generator location and other constraints.

Settlement in the NEM

Settlement is the process of reconciling how much electricity a customer used and at what price so retailers (such as Flow Power) can bill them. It is also used to determine how much revenue should be paid to generators.

How were power prices calculated before five-minute settlement?

Before explaining how prices are calculated, it is important to understand two concepts:

- The “dispatch price” is the price of the most expensive generator that needs to be dispatched in order to balance demand and supply in each five-minute period.

- The “trading price” is the price used for settlement, i.e. the price used to pay generators and the price charged to consumers.

The dispatch price is determined every five minutes by the marginal generator. That means, the price in the market is based on the bid of the most expensive, dispatched generator.

In the above example with generators A, B, C, and D, as the highest dispatched bid was $300/MWh, then the dispatch price would have been $300/MWh. Under thirty-minute settlement, this dispatch price was set every five minutes based on the updated generator bids and demand forecasts. Before five-minute settlement this dispatch price was not necessarily the same as the trading price.

Under thirty-minute settlement, while the dispatch price was set every five minutes, the trading price was set every thirty minutes. The trading price was calculated as an average of the 6x dispatch prices and consumers paid this trading price multiplied by the sum of their power consumption for the trading interval.

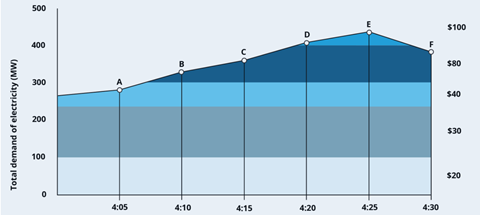

For example the price set in each of the six dispatch intervals (the dispatch intervals ending at 4:05, 4:10, 4:15, 4:20, 4:25, and 4:30) within a single trading interval (the 4:30 trading interval) were averaged to determine the wholesale price.

In the figure above, we could average the 6x dispatch prices to calculate a trading price of around 37$/MWh, which all generators would be paid for the trading interval.

As dispatch intervals were aggregated to thirty-minute blocks, this is referred to as thirty-minute settlement.

How are power prices calculated with five-minute settlement?

The introduction of five-minute settlement on October 1st 2021 means the trading price is equivalent to the dispatch price. Instead of aggregating 6x dispatch intervals into thirty minute trading prices, prices and payments are calculated and settled based on a five-minute wholesale price.

This change had implications for both how generators bid into the market, and the prices consumers pay which we’ll explore in more detail below.

What has changed with the introduction of five-minute settlement?

Five-minute settlement aligns dispatch and trading prices. A change to how the wholesale price was set also means potential changes to behaviours and incentives in the wholesale market. We’ve looked at some price spikes and the behaviour within a thirty-minute window that should change as the market adjusts to five-minute settlement.

Price spikes under thirty-minute settlement

Under thirty-minute settlement, because the trading price in the NEM was based on the average price over 6x dispatch intervals, it meant that one high dispatch price could make the trading price for the whole thirty minutes high.

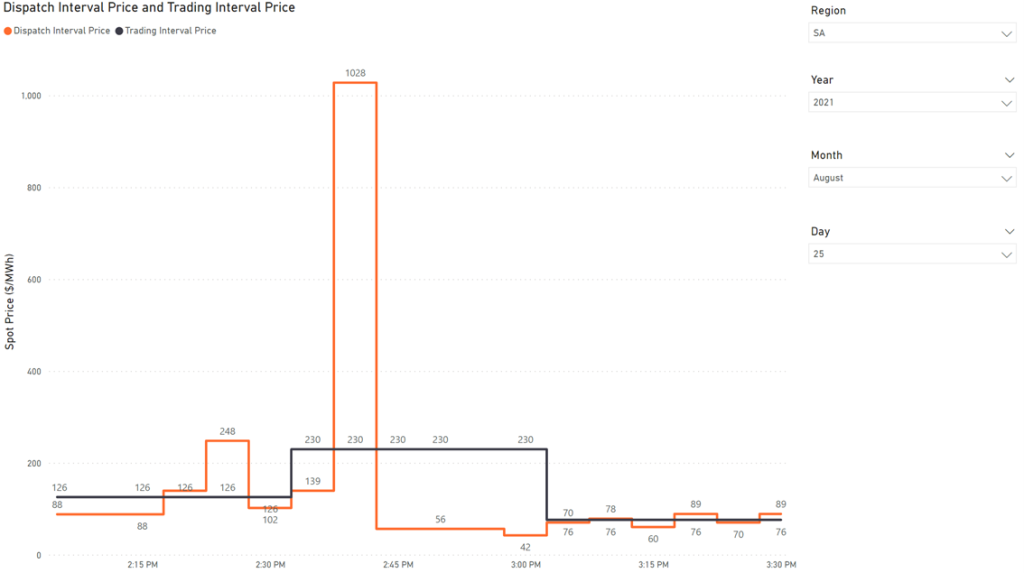

Using a real-world example, the trading price for 3pm on August 25th was $230/MWh– even though one of the five minute windows within the thirty minutes had a dispatch price of $1,028/MWh.

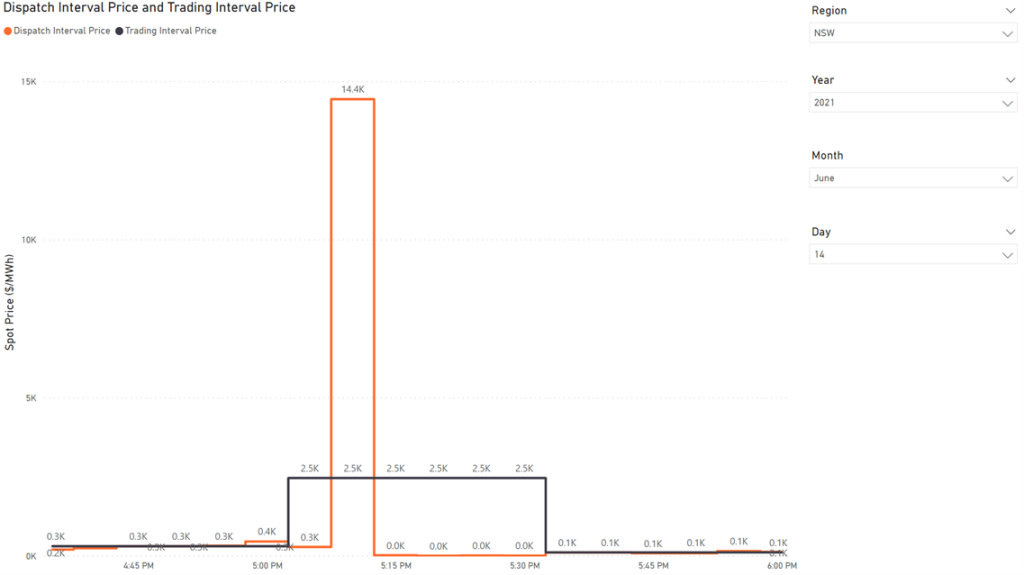

In another example, dispatch price spiked to $14,400/MWh for a single dispatch interval. Immediately following this, dispatch intervals were significantly lower and this resulted in the total trading price for the trading interval being $2,500/MWh.

Price spikes, like the one above, are often caused by a tight demand/supply balance. Additionally, the pattern of “one highly priced dispatch interval followed by several low priced dispatch intervals” usually indicates significant rebidding activity (rebidding refers to generators changing their offers, often in response to changed market conditions).

One of the reasons this rebidding occurs is that if a single dispatch interval spikes to the market cap of $15,000/MWh, then the minimum trading price is guaranteed to be $1,666.67/MWh for the trading interval. This is calculated by assuming that all of the other dispatch prices in the trading interval are at the market floor of -$1,000/MWh. So, after a significant dispatch price spike, we often see generators rebidding much lower prices to try and generate as much as they can in the trading interval, to guarantee they get paid the trading price of at least $1,667/MWh.

From a consumer standpoint, this means that if the dispatch price spike occurs near the start of a trading interval, it makes sense to try and reduce load for the remainder of the trading interval.

However, it can be difficult to manage load when dispatch price spikes occur nearer the end of a trading interval. In this scenario, consumers cannot “un-use” the load they have already used in the trading interval and they could be exposed to the higher priced trading interval (regardless of if they reduced their load when the spike occurred).

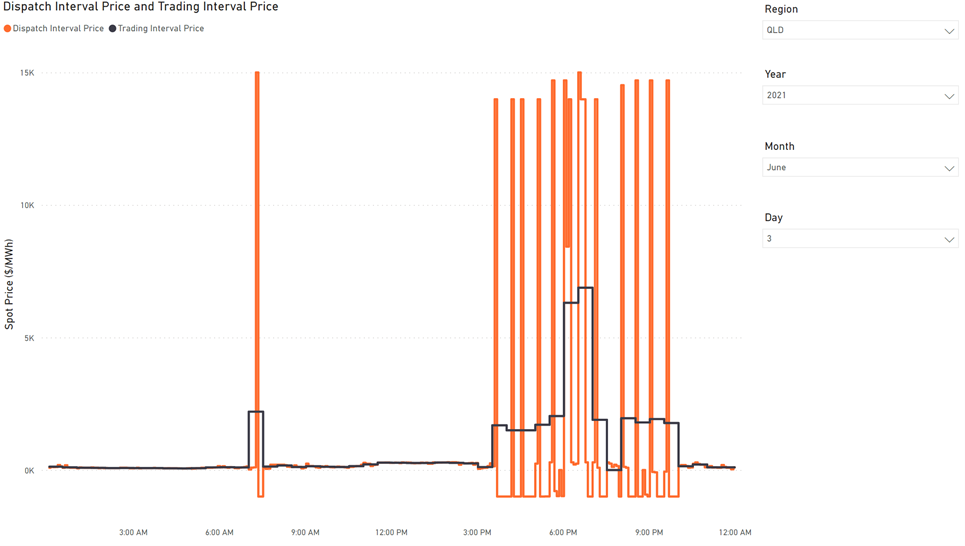

In its extremes, market conditions can result in multiple successive trading intervals where each trading interval has one or two extremely high dispatch prices, surrounded by lower (and even negative) dispatch prices – which results in a consistently high trading price. The figure below demonstrates an example of these extreme pricing outcomes.

In a different scenario, sometimes physical incidents (such as fires, floods or explosions) can cause a region to lose lots of capacity in a short period of time, and this can be a cause of high prices.

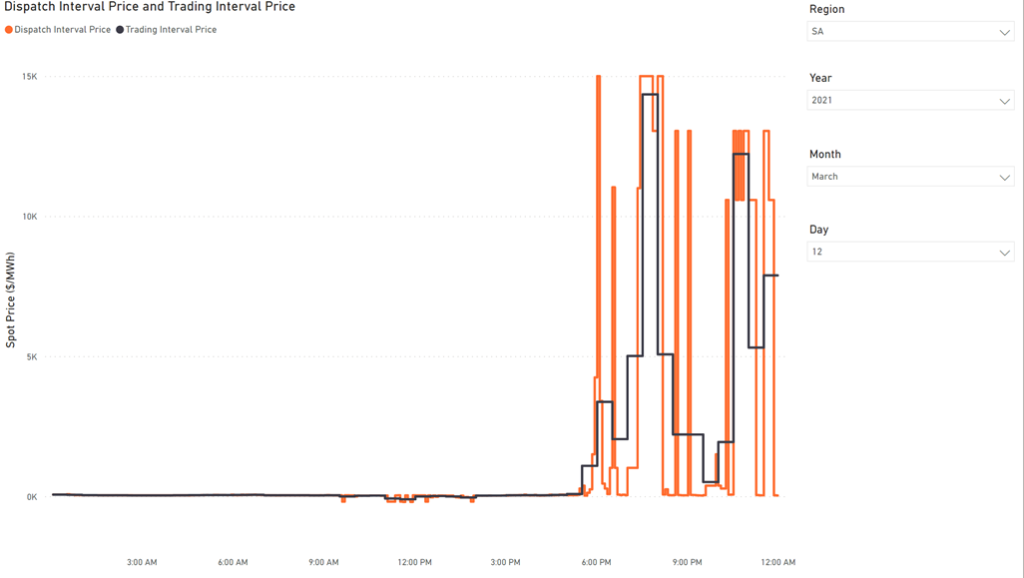

In this situation, dispatch prices tend to be more stable at high prices (rather than constantly ricocheting from high to low), as indicated by the graph below:

Possible five-minute settlement changes over time

It is not known exactly how wholesale prices will change over time with the change to five-minute settlement; however, it is clear that some of the intra-thirty-minute bidding behaviour will cease.

For example, under thirty-minute settlement, if the price spiked once in a trading interval, generators could re-bid to get dispatched in the remaining dispatch intervals within the trading interval to still benefit from the price spike. With five-minute settlement, each dispatch interval becomes more price-independent from those in the same half hour.

As such, over time we expect to see less aggressive rebidding within the half hour, as generators would not be able to make use of the price averaging anymore.

We may see the operation of thermal peaking generators impacted. These generators often make money selling “caps”, which exposes them to prices exceeding $300/MWh. The introduction of five-minute settlement might result in more uncertainty for these generators in how they manage this exposure and make sure they’re online to generate when prices exceed this threshold.

The introduction of five-minute settlement should support batteries and fast acting demand response, especially for short price spikes. Responding to five-minute price spikes is challenging, but the cost to a customer will no longer depend on the other five prices in the trading interval.

What this means for Flow Power customers

The introduction of five-minute settlement means more efficient price signals for customers responding to spot prices. Where the thirty-minute settlement could create some scenarios for customers where price spikes were difficult to avoid, five-minute settlement gives customers (particularly those that can respond quickly) the chance to respond to high priced events. This is good news for customers with flexible demand who will be able to take advantage of clearer pricing signals.

All Flow Power C&I customers, whether signed up to Power Active, a Power Purchase Agreement (PPA) or for Wholesale, use wholesale market signals. That means Flow Power customers can take advantage of the wholesale price when its low, and get value out of demand response when the price is high.

The introduction of five-minute settlement should strengthen the rewards for demand flexibility, so there’s never been a better time to explore options and the opportunities and potential benefits of demand response and automation!

Conclusion

Five-minute settlement generally should make the way the wholesale price is set more efficient. While we’ve outlined some potential changes above, keep in mind that five-minute settlement is new and it will take some time before the impacts of the change are well understood.

For example, while generators may change how they bid, this is itself dependent upon observing how other generators decide to bid. While this uncertainty exists, it might lead to some different pricing outcomes than usual.

Any questions? Our energy specialists are here to help.

If you’re an existing Flow Power customer, please do not hesitate to reach out to your account manager.

If you’re not a Flow Power customer, feel free to contact our friendly team:

1300 08 06 08

hello@flowpower.com.au

Alternatively, you can submit your questions through our website contact form here.