February 2022 national energy market insights

February saw varied spot price outcomes between the mainland NEM regions.

Queensland continued to have supply-demand issues (especially on hot days), and interconnector constraints resulted in some price volatility. New South Wales had fairly consistent spot prices throughout the month. Although the limited interconnection between New South Wales and the other regions with surplus renewable and cheaper energy, resulted in higher prices when compared to Victoria (which was able to import from both South Australia and Tasmania).

In South Australia and Victoria, average spot prices were milder, and the long-term trend of decreased middle-of-the-day demand continued. Typical supply-demand tightness (likely exacerbated by weather increasing the demand and generator outages reducing supply) resulted in some price volatility through the month, though the spot market was relatively uneventful. Interestingly, AEMO declared a brief Market Suspension in South Australia on the 18th of February which caused predetermined pricing in the region for around 2 hours.

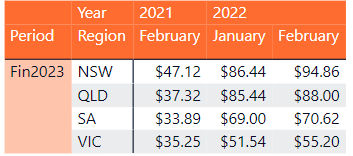

Higher spot prices continue to influence forward contract prices. This has been observed in the traded price for 2023 financial year contracts. While energy prices continue to increase, the month-on-month percentage increase was lower this month (February) than it was between December 2021 and January 2022.

- New South Wales is up 101% from a year ago, and 10% from January 2022

- Queensland is up 136% from a year ago, and 3% from January 2022

- South Australia is up 108% from a year ago, and 2% from January 2022

- Victoria is up 57% from a year ago, and 7% from January 2022

While the year-on-year hours of negative prices increased, the average price was higher for these negative periods. This is due to fewer negative prices going below -$100/MWh (although the market floor was reached in Victoria due to constrained interconnectors).

February 2022 NEM insights – by state

Click on our dynamic graph below to view the figures for your state:

New South Wales February 2022

- Average spot price of $82.98/MWh

- Spot prices went to $15,100/MWh for a single interval on the 21st, due to hot weather causing increased demand and several generator outages in the region

- Similar demand curve to February 2021

- Higher demand in the morning peak compared to January 2022, but lower demand in the afternoon, evening, and overnight

- Rooftop solar generation continued to show strong year-on-year growth, though February 2022 on average had lower solar generation than January 2022

Queensland February 2022

- Average spot price of $219.20/MWh, due to several exceptionally high price events. If we exclude these events, the average underlying spot price was $97.72/MWh

- Lower average demand at all times compared to February 2021, but similar general demand shape

- February 2022 generation availability was lower than February 2021, though slightly higher than in January 2022

- Interconnector constraints continued to affect sharing of resources between Queensland and New South Wales, which impacted the spot price dynamics

South Australia January 2022

- Average spot price of $54.14/MWh, with 116 hours of negative prices

- Generally low levels of spot price volatility (less than an hour of prices >$300/MWh), with a notable exception on the 23rd where spot prices hit $4,031.78 for a single interval

- Similar demand profile to February 2021, with lower middle-of-the-day demand

- A Market Suspension was declared on the 18th for the intervals ending 14:20 to 16:10 – during these times, AEMO set spot prices based on the market suspension guidelines. An AEMO market notice stated that “a SCADA service interruption” was the cause of the suspension. This is generally rare and is usually caused by a breakdown in AEMO systems or the SCADA network that AEMO relies on.

Victoria January 2022

- Average spot price of $53.94/MWh, with spot prices only going above $300/MWh once

- Around 80 hours of negative prices

- Lower average demand at all times compared to February 2021, with the impact of the “duck curve” amplified (lower middle-of-the-day demand)

- Average Rooftop solar generation increased by around 33% compared to February 2021, though was at similar levels to January 2022

- Interconnector constraints to avoid tripping resulted in the VIC/NSW interconnector forced to import ~1500MW into Victoria. This resulted in the Victorian spot price to hit the market floor of -$1000/MWh for around half an hour

Looking ahead to March 2022

When discounting high spot prices due to volatility, the underlying spot prices were consistent with January 2022. The divide in spot price outcomes between the northern and southern mainland regions persists.

In March, The Bureau of Meteorology predicts higher daily maximum temperatures in Queensland, with historically similar maximum temperatures in South Australia and Victoria, and lower maximum temperatures in New South Wales. The Bureau also forecasts higher than average rainfall NEMwide – while this may not have a large impact on demand, it will likely decrease both grid-scale and rooftop solar output.

Forward 12-month contracts for all mainland NEM regions increased throughout the month, however the increase was less severe in Victoria and South Australia. This divide in prices is likely due to continued constraints on the NSW/VIC interconnector, and we expect the divide to continue until EnergyConnect (the new SA/NSW interconnector) in completed in 2025. Late in the month Origin Energy announced it was bringing forward the closure of the Eraring Power Station, the largest generator in the NEM, to August 2025. The news, though given with several years notice, appeared to further contribute to gains for forward contract prices, even those nearer term than the mid-2025 closure date.

Any questions? Our energy specialists are here to help.

If you’re an existing Flow Power customer, please do not hesitate to reach out to your account manager.

If you’re not a Flow Power customer, feel free to contact our friendly team:

? 1300 08 06 08

Alternatively, you can submit your questions through our website contact form here.