Looking at what’s been in the news in the past two and a half years, the following statement may seem tongue-in-cheek, but there’s no other way to say it:

June has been an unprecedented month for the National Electricity Market (NEM), and a perfect storm of factors affecting operation resulted in the Australian Energy Market Operator (AEMO) stepping in and taking extraordinary action. The current spot prices, while high historically, may reflect a “new normal” for the next couple of quarters.

In this wrap-up, we’ll try to explain some terms you may be unfamiliar with (Market Suspension, Administered Price Cap, etc), and chronologically go through what happened in the lead up to and during the market suspension.

Conditions from May (thermal outages, high fuel prices, and high demand) continued into early June, and resulted in high spot prices in the first two weeks of the month across all regions. In these two weeks, spot prices were above $300/MWh for more than two thirds of all intervals in New South Wales and Queensland (often going to $1000/MWh), and around half of all intervals in Victoria and South Australia. The average gas price for June was almost $40/GJ, which was an increase from the already-historically-high prices of ~$30/GJ in May.

Explanation of terms

Before we continue, it’s worth explaining some of the mechanisms AEMO had to introduce to alleviate the market. In ordinary times, prices are set via the NEM Dispatch Engine, which finds the cheapest combination of generators to dispatch based upon the bids generators place. All generators are paid the bid price of the most expensive dispatched bid.

CPT and APC

In order to protect consumers from prolonged periods of extremely high prices, a Cumulative Price Threshold (CPT) is set. The CPT is breached when the 7-day rolling sum of all spot prices in a region exceeds $1,359,100 (which corresponds to around 7.5 hours of spot prices at the Market Price Cap (MPC) of $15,100/MWh).

When the CPT is reached, AEMO steps in and declares an Administered Price Cap (APC) of $300/MWh. The APC exists to protect consumers by keeping spot prices from continuing to reach very high levels. The APC is lifted when the 7-day rolling sum of spot price in a region returns to lower levels (that is, below the CPT, with conditions looking unlikely to have the rolling sum breach CPT again in quick succession). While the price is being capped at the Administered Price Cap, the spot price is still set by generator bids, and the resultant spot price is then capped at $300/MWh.

If the price is capped at the APC, generators who have marginal costs higher than $300/MWh can apply to be reimbursed the difference between spot price and their marginal costs through the APC Compensation Scheme. This marginal cost is calculated on an individual generator basis.

If a generator decides it does not want to generate but AEMO determines it necessary to maintain the reliability of the power system, AEMO can direct these generators to generate (even if they bid no availability). When this happens, the amount they are paid is calculated from a formula and generators can request more if the amount does not cover their generation costs.

Market Suspension

In times of extreme market stress, AEMO can declare to suspend the spot market. In this situation, bidding and dispatch continues where possible, but AEMO issues dispatch instructions based on what they believe will be the most practical. Spot price is set based on a Market Suspension Pricing Schedule, which is published weekly, 2 weeks in advance. The schedule is region specific and sets half-hour prices for business/non-business days based on a 28-day average for that specific region, day type, and time period (with 48 half hour periods in one day), with resultant prices then capped at $300/MWh.

What happened in June

Let’s breakdown the events that took place.

Cumulative Price Threshold (CPT) reached

Consistently high spot prices in the first two weeks of June resulted in the 7-day rolling sum of prices in New South Wales and Queensland inching closer to their respective Cumulative Price Thresholds. In that 2nd week, Queensland had six out of seven days where the spot price reached $10,000/MWh for at least a couple of intervals each day. On Sunday the 12th of June at 18:45 (AEST), Queensland breached CPT and entered into an Administered Price Period (APP), where the spot price was capped at $300/MWh.

Typically, APPs do not last for an exceedingly long time (an APP earlier this year in South Australia only lasted for a couple of hours), as market conditions generally recover. However due to various thermal outages and the high cost of generation fuel, a quick recovery seemed unlikely.

One market interaction which contributed to the problem was that while the Administered Price Cap was set at $300/MWh, the marginal cost for gas generators (with the price of gas at ~$40/GJ) was around $400/MWh. While it was possible for generators to recoup their costs through the APC Compensation Scheme, many gas generators bid zero capacity and opted to be directed by AEMO to generate instead.

All NEM states enter an Administered Price Period

During this period, interconnector flows between Queensland and New South Wales resulted in the 7-day rolling sum of spot price in NSW increasing gradually – while the price was capped at $300/MWh, interconnector interactions with spot price meant that the uncapped spot price in Queensland was being used for New South Wales spot price calculations. New South Wales similarly breached CPT and entered an APP on Monday the 13th of June at 18:25 (AEST). The dominos then continued to fall across the NEM, with South Australia (at 21:50 AEST) and Victoria (at 21:55 AEST) entering an APP later that evening.

On Tuesday the 14th and Wednesday the 15th of June, anybody looking at only spot prices might be unaware that the energy market was going through a crisis, as they would have only seen the prices capped at $300/MWh. However, the 7-day rolling sum continued to rise in all regions (With Queensland reaching $9,500,000, more than 7 times the CPT). This is because while the spot price was capped at $300/MWh, the uncapped spot price was frequently reaching MPC ($15,100/MWh). This was partially due to many generators not bidding their generation capacity and instead opting to be directed by AEMO.

AEMO temporarily suspends the market

At 14:05 (AEST) on the same Wednesday, AEMO took the unprecedented action of suspending the spot market in all regions of the NEM. They did this as it had “become impossible to operate the spot market in accordance with the provisions of the Rules”.

As described above, this resulted in scheduled pricing taking effect in all regions, and AEMO directing many generators to dispatch rather than relying on the typical bid stack. This market suspension continued for a week, during which time generators were encouraged to accurately report their dispatchable capacity so AEMO could effectively meet demand.

There were significant supply-demand shortages occurring, resulting in AEMO dispatching Reliability and Emergency Reserve Traders (RERT) once in Queensland and thrice in New South Wales. Over the week, generators previously offline for maintenance returned to service, and their additional capacity gave AEMO the confidence to end the market suspension on Friday the 24th of June at 14:00 (AEST).

Following the resumption of the spot market, spot prices in all regions seem to return to similar levels of the first week of June – while historically high, the additional returned capacity of previously offline thermal generation should provide a buffer against more Administered Price Periods and Market Suspensions.

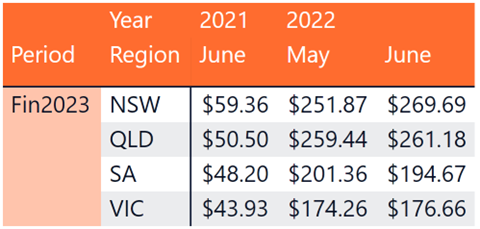

The trend of increasing forward prices for FY 2023 has continued, with prices in three of the four mainland regions exceeding $200/MWh:

- New South Wales is up 354% from a year ago, and 7% from May 2022

- Queensland is up 417% from a year ago, and 1% from May 2022

- South Australia is up 304% from a year ago, and down 3% from May 2022

- Victoria is up 302% from a year ago, and down 1% from May 2022

June 2022 NEM insights – by state

Click on our dynamic graph below to view the figures for your state:

To navigate to a particular past month, select page 2 on the bottom of the graph, and then use the drop down menu to make a selection.

New South Wales June 2022

- Average spot price of $398.04/MWh, with 4 hours of negative prices and 538 hours above $300/MWh

- $80/MWh difference in average spot prices at the cheapest (mid-morning) and most expensive (almost all other) times

- Similar demand to June 2021, with a slightly higher morning peak

- Much higher demand than May 2022

Queensland June 2022

- Average spot price of $400.23/MWh, with 33 hours of negative prices and 361 hours above $300/MWh

- $160/MWh difference between the average prices at the cheapest and most expensive times of day

- Similar demand profile to June 2021, with slightly higher morning/evening peaks and lower middle-of-the-day demand

South Australia June 2022

- Average spot price of $302.59/MWh, with 61hours of negative prices and 355 hours above $300/MWh

- $180/MWh difference between the average prices at the cheapest and most expensive times of the day

- Price volatility during the middle of the month when interconnector constraints led to decreased morning/evening supply

- Similar demand to June 2021, though higher at all times compared to May 2022

Victoria June 2022

- Average spot price of $296.49/MWh, with 34 hours of negative prices and 310 hours above $300/MWh

- $160/MWh difference between lowest (early morning) and highest (evening peak) time-based average underlying spot price

- Higher demand across the board compared to June 2021, which itself was higher than May 2022

- Lower rooftop solar generation than in May 2022, despite likely a similar or greater number of solar panels

It truly was an unforgettable month in the NEM, with a week-long system-wide market suspension and record-high gas prices. Importantly, it is prudent to note that without the safeguards put in place, spot price outcomes for the month could have been much worse.

Looking ahead to July 2022

In July, the Bureau of Meteorology is predicting higher daily minimums and increased rainfall across the NEM. While daily maximums are set to be higher than previous averages in Victoria and Tasmania, the Bureau also predicts lower maximums in much of Queensland and New South Wales. Higher than average does not mean high though, as previous years have seen winter peak demand in June, there have been many in July as well.

As mentioned previously, while the return of thermal generation capacity is likely to alleviate supply-demand issues, high generation fuel costs mean that current high spot price outcomes are unlikely to decrease soon.

Interestingly, days with high wind and solar generation are having an impact on softening spot prices (especially in South Australia and Victoria), which highlights the importance of moving towards cheaper renewable generation over time.

It is worth noting that earlier we mentioned a Cumulative Price Threshold (CPT) of $1,359,100 and Market Price Cap (MPC) of $15,100/MWh. From the 1st of July, the MPC will increase to $15,500/MWh, and the CPT will increase to $1,398,100. This still means that the CPT corresponds to around 7.5 hours of MPC prices.

These current spot prices are very high compared to historical levels; however, these kinds of price shocks could be expected to reoccur while our energy system is dependent on burning gas and coal to produce most of our electricity. These events have been a culmination of many factors, but it is at least partially due to poor policy planning.

Unfortunately, until we transition the power system to renewables, storage and demand flexibility, it is possible prices will return to these levels in the future. For us, this reinforces the importance of continuing to invest in renewable energy and energy solutions to manage how we use our electricity.

Any questions? Our energy specialists are here to help.

If you’re an existing Flow Power customer, please do not hesitate to reach out to your account manager.

If you’re not a Flow Power customer, feel free to contact our friendly team:

? 1300 08 06 08

Alternatively, you can submit your questions through our website contact form here.