March at a glance

Warm weather continued in March, with high electricity demand coming from the increased need for cooling. Despite this, wholesale electricity prices were less volatile than January and February, with fewer instances of extreme spot prices.

This is what we would usually expect to see at this time of year. In the shoulder months (i.e., outside the peaks of summer and winter), the milder weather conditions usually mean the demand for electricity is lower, which in turn typically leads to lower, more stable wholesale prices.

Electricity price insights

Electricity prices are typically an indication of the balance between demand and supply, and this was reflected in average prices for March.

In New South Wales and Queensland, demand for electricity and spot prices fell when compared to previous months. In South Australia and Victoria, the inverse occurred – demand for electricity and underlying prices rose.

While temperatures and electricity demand are key drivers for wholesale electricity prices, explaining these differing trends is a little more complicated than “high demand = high prices.” There are other factors that contributed to the rising and falling prices, such as renewable generation, baseload availability, generator bidding behaviour, and interconnector availability.

There were not many incidences of extreme spot prices across the National Electricity Market (NEM) in March. The three incidences of price volatility in the month were in South Australia which coincided with high demand, solar output ramping down, and a low wind production. Of these, only two days had a single 5-minute interval of extreme spot prices before returning to usual levels below $300/MWh.

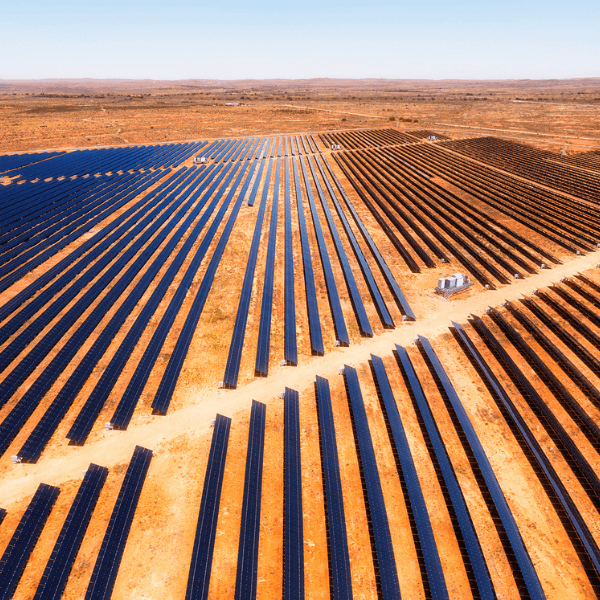

In March, the total proportion of renewable generation in the NEM was 38.34%, which is 3% higher than it was a year ago in March 2023.

Changes in forward contract prices for FY25

Forward prices for 12-month futures in all mainland regions remained relatively stable through March, ending the month slightly higher than at the end of February.

- New South Wales prices are down 18% from a year ago, and up 2% from February 2024

- Queensland prices are down 6% from a year ago, and 1% from February 2024

- South Australia prices are down 19% from a year ago, and up 4% from February 2024

- Victoria prices are down 14% from a year ago, and up 5% from February 2024

March 2024 NEM insights by state

New South Wales

- Average spot price of $70/MWh, with 38 hours of negative prices and no hours above $300/MWh

- $160/MWh difference in average underlying spot prices at the cheapest and most expensive times of day

- No daily intervals with an average negative price over the whole month

- 34% total renewable generation through the month

- Minimum demand of 5,038 MW

- Peak demand of 11,545 MW

Queensland

- Average spot price of $74/MWh, with 57 hours of negative prices and 4 hours above $300/MWh

- $200/MWh difference between the average underlying prices at the cheapest and most expensive times of day

- No daily intervals with an average negative price over the whole month

- 28% total renewable generation through the month

- Minimum demand of 4,998 MW

- Peak demand of 9,212 MW

South Australia

- Average spot price of $67/MWh, with 132 hours of negative prices and 7 hours above $300/MWh

- $190/MWh difference between the average underlying prices at the cheapest and most expensive times of the day

- Average prices were negative for all periods between 9:30 AM and 2:00 PM during the month

- 77% total renewable generation through the month

- Minimum demand of 120 MW

- Peak demand of 2,845 MW

Tasmania

- Average spot price of $70/MWh, with 10 hours of negative prices and 2 hours above $300/MWh

- $90/MWh difference between lowest and highest time-based average underlying spot price

- No daily intervals with an average negative price over the whole month

- >99% total renewable generation through the month

- Minimum demand of 924 MW

- Peak demand of 1,422 MW

Victoria

- Average spot price of $52/MWh, with 126 hours of negative prices and 4 hours above $300/MWh

- $180/MWh difference between lowest and highest time-based average underlying spot price

- Average prices were negative for all periods between 9:00 AM and 2:30 PM during the month

- 37% total renewable generation through the month

- Minimum demand of 2,234 MW

- Peak demand of 8,856 MW

March temperatures

Average temperatures in March were higher across the NEM, ranking as the hottest March since 1910 in South Australia (based on average minimum and mean temperatures). By these metrics, it was also in the top 10 for hottest March’s in the other states. This trended globally and was the 10th consecutive month that has set a new warm temperature record. That is, the hottest March ever, preceded by the hottest February ever, preceded by the hottest January ever, and so on for the previous 10 months.

Looking ahead to April 2024

Bucking the trend of previous months, the Bureau of Meteorology has forecast a cooler-than-normal April for much of the NEM. North-eastern New South Wales and along the eastern coast of Queensland are predicted to be hotter than average for April however. Rainfall is forecast to be lower-than-usual for South Australia and inland Queensland, though higher-than-usual in central and eastern Victoria.

While previous summers have typically fizzled out prior to March, recent heat waves and weather predictions suggest there could still be some hot weather before the winter months.

An El Niño event is still active in Australia, though very close to its end, with four out of seven climate models indicating its conclusion by the end of April. As a reminder, while the Bureau has not made an official announcement, other weather models worldwide have predicted a return to La Nina conditions in winter this year. La Nina conditions would typically result in a colder, wetter spring and early summer.

Throughout April, there are a series of scheduled base load outages in New South Wales and Victoria. This is normal for Autumn, where planned outages for maintenance are completed before the cold weather of winter increases demand. In the first week of April, unit C3 of Queensland’s Callide power station is set to return after almost 30 months offline (due to a cooling tower collapse). While the unit has a capacity of 450 MW, it is expected to return at only half capacity at first then slowly ramp up to full capacity over time. The other Callide unit is set to return to service in July this year. As always, there is always the risk of unplanned outages resulting in reduced capacity at any time.

Any questions? Our energy specialists are here to help.

If you’re an existing Flow Power customer, don’t hesitate to reach out to your account manager.

If you’re not a Flow Power customer, feel free to contact our friendly team:

1300 08 06 08

Alternatively, you can submit your questions through our website contact form here.