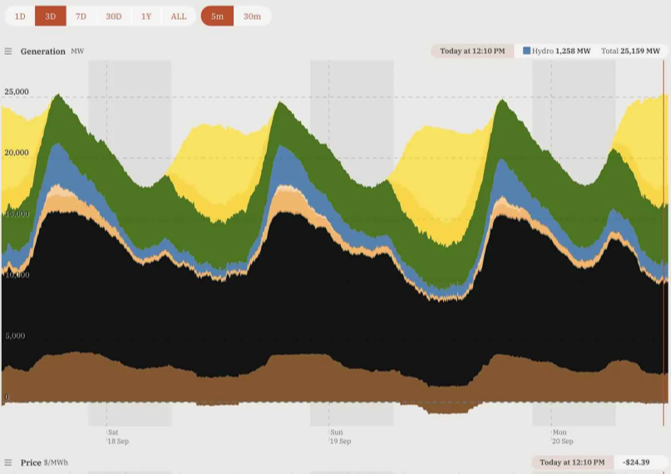

September 2021 was the last month to settle prices using thirty-minute settlement, with October 2021 being the first to use five-minute settlement.

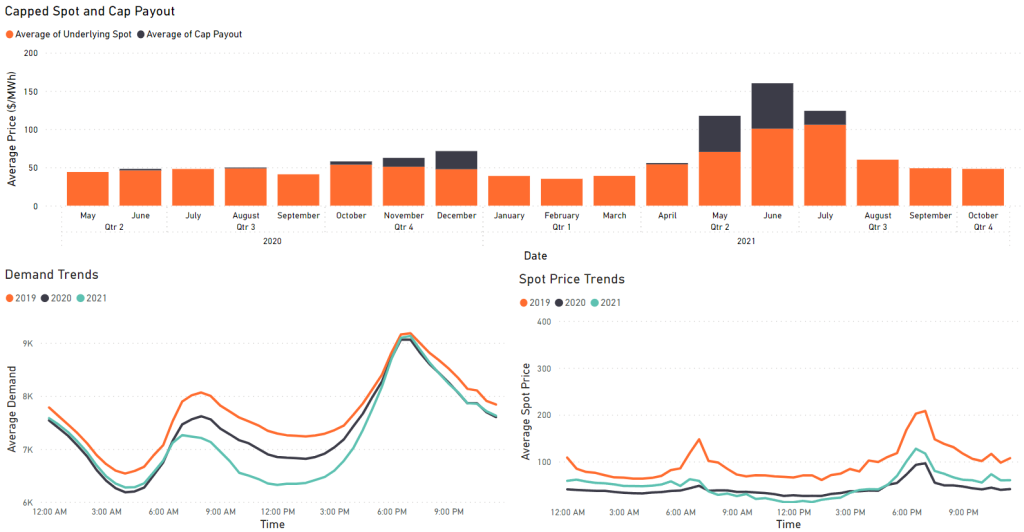

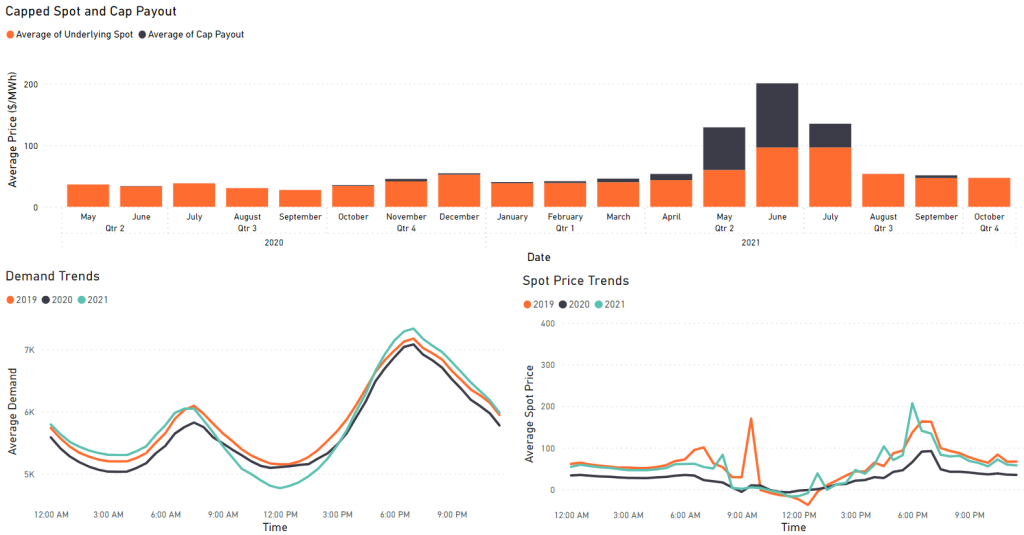

Throughout the month, the wholesale electricity market has continued to become more favourable for customers, with the month-on-month average spot price falling in all regions. While we typically see monthly prices for Q3 peak in July and taper off in the following months, various National Energy Market (NEM) events have led to the change being more pronounced in 2021.

You can learn more about these events in our previous energy market wrap-ups here.

The trend of hollowing demand curves in the middle of the day has continued, while peak demand levels have remained unchanged in most cases.

Renewable energy records broken

September 2021 also had the highest monthly percentage of energy generated by renewables in NEM history. In addition to the environmental benefits there were economic wins too – especially for some Flow Power customers.

Low (and even negative) prices were common during the month, and all mainland NEM regions have seen low average prices throughout the month.

Not counting August 2021, September has had more than double the number of negatively priced intervals as any other month in the past seven years.

September 2021 summary

September has seen lower prices in all mainland regions compared to August 2021, along with higher renewable penetration. The trend of the “deepening duck curve” continues, with similar or higher demand during peak periods, and lower demand in the middle of the day.

Intra-day spot price profiles have highlighted the importance of being flexible and using power at the right time – while average prices are cheaper on the whole, they are actually more expensive in peak periods than before.

State-by-state key figures and takeaways

New South Wales September 2021

- 121 negatively priced intervals (fewest of the mainland regions)

- The only region to have no time intervals with a negative monthly average spot price

- Lower average morning demand compared to the previous two Septembers (which may have been caused by New South Wales’ lockdown) with unchanged evening peak demand

- Continuing trend of lower afternoon demand

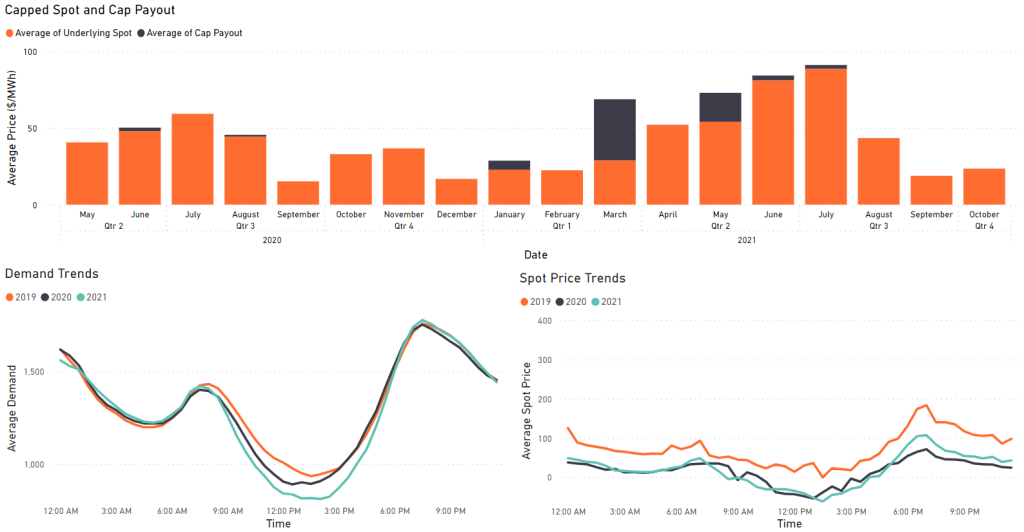

Queensland September 2021

- Two single-interval price spikes (on the 1st, and the 19th), with prices reaching approximately $2000/MWh

- 241 negatively priced intervals and negative average spot price between 08:30 AM and 02:00 PM

- Generally similar intra-day spot price profile to August 2021

- Same if not higher demand peaks in the morning and evening, with lower off-peak demand

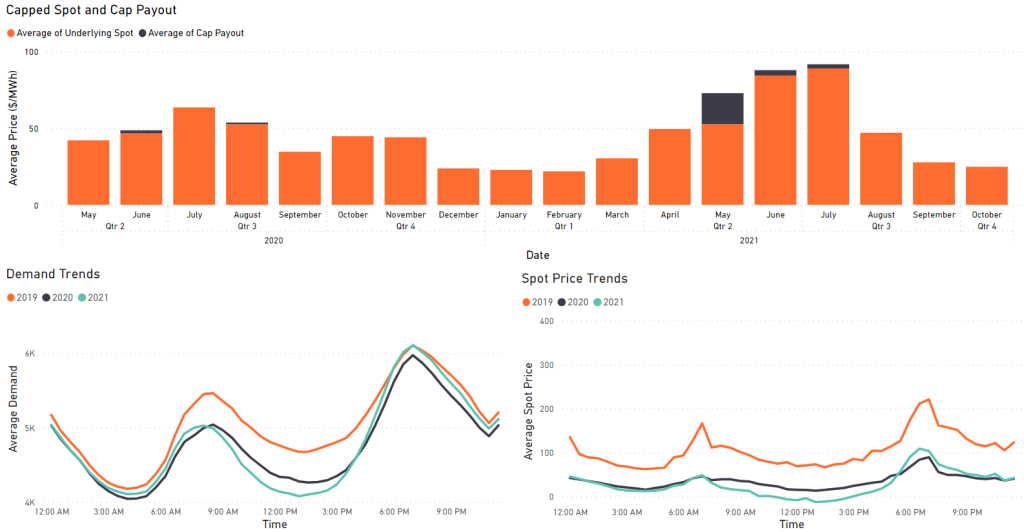

South Australia September 2021

- Lowest monthly average spot price since September 2020

- 516 negatively priced intervals, and average prices for the month between 8:30 AM and 04:00 PM falling into the negatives. Similar peak demand, though much lower afternoon demand, likely due to high solar penetration

- Record low operational demand on the 26th of September, with 84.4% of energy being provided by rooftop solar PV for a single five-minute interval

Victoria September 2021

- Like South Australia, lots of negative prices (458), with average prices between 10:30 AM and 03:30 PM being negative for the month

- Compared to the past 2 years, higher evening peak prices, and lower prices in middle of day

- Demand curve shows similar patterns to other regions, with lower afternoon demand and similar or higher morning/evening peak demand

Looking at October 2021

Looking forward to October, contract prices were relatively stable through September – prices for Q4 2021 have been decreasing slightly across the board, though Queensland and New South Wales have seen minor increases in the past 2 weeks. Historically, September and October have had similar demand and spot prices.

The past two years has seen a similar number of negatively priced intervals in the two months, though the start of a new quarter may bring with it new spot price trends. As we come out of the shoulder seasons, we can expect to see the number of negative prices falling – this is due to typically warmer weather and increased demand for cooling.

Importantly, the NEM switched from thirty-minute settlement to five-minute settlement on October 1st 2021, which may affect spot prices.

We’ve written a simple explainer on the five-minute settlement here. We’ve also got an article that takes a close look at the NEM, bid stacks and five-minute settlement here.

Any questions? Our energy specialists are here to help.

If you’re an existing Flow Power customer, please do not hesitate to reach out to your account manager.

If you’re not a Flow Power customer, feel free to contact our friendly team:

? 1300 08 06 08 (within business hours)

?️ Live chat message (within business hours via the chat button at the bottom of your screen)

Alternatively, you can submit your questions through our website contact form here.