With negative prices becoming increasingly frequent and Australia’s continuous renewable energy growth, Flow Power’s energy specialists have compiled this guide to help you discover the positives of negative prices.

Read on to learn why prices can go negative, how often negative pricing occurs, and what it all means for Flow Power customers.

Why do negative prices occur?

The wholesale electricity price is set every five minutes based on supply and demand. Generators (such as solar farms or coal-fired power plants) make offers to the Australian Energy Market Operator (AEMO) to supply customers and AEMO will create a “bid-stack” that compares these offers. AEMO will dispatch generation to meet supply based on these offers – the cheapest offers through to the marginal offer are accepted, and those generators are dispatched. Click here to learn more about generator bids.

The cheapest generation offers in the bid stack are typically offered at a negative price. While this seems unusual – a generator offering to pay to generate – generators do so to guarantee dispatch knowing that AEMO will dispatch the generators with the lowest price first. However, in most instances, these generators receive a positive wholesale price because the price paid to all generators is set by the offer of the marginal generator i.e., the price of most expensive generator needed to make sure there’s enough supply dispatched to meet consumer demand.

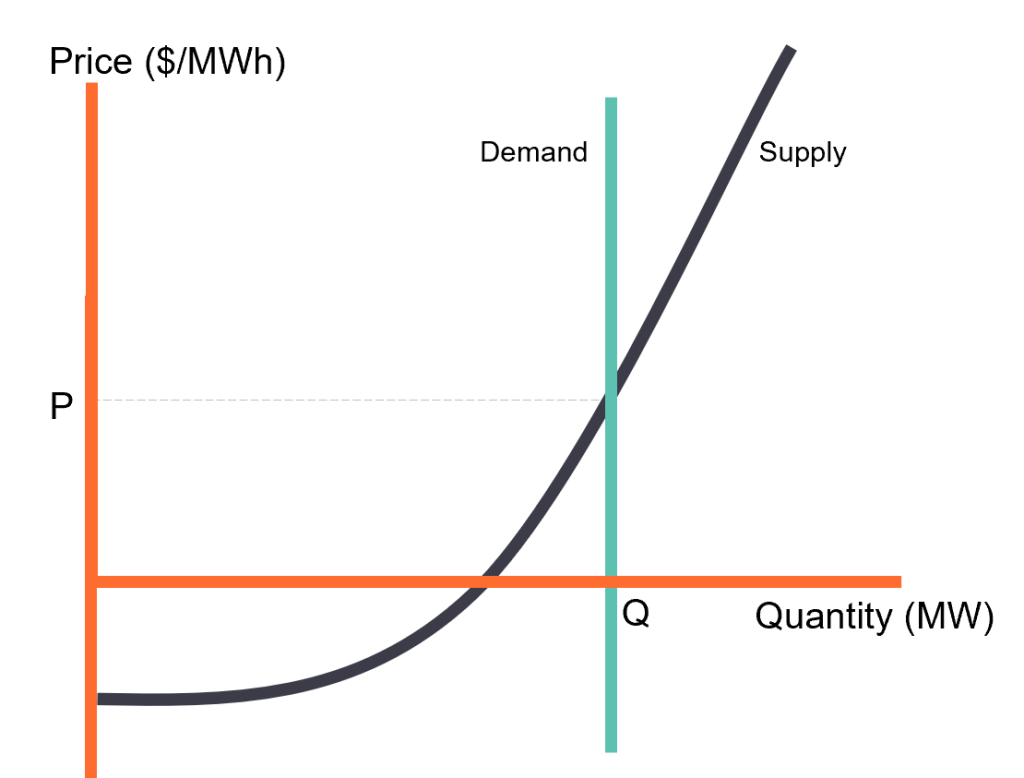

The diagram below shows how the wholesale price is set by where demand for electricity intersects the offers made by generators.

Normally, the price is set based on cost of operating different types of generation i.e., the cost of running a coal-fired power station or a gas plant.

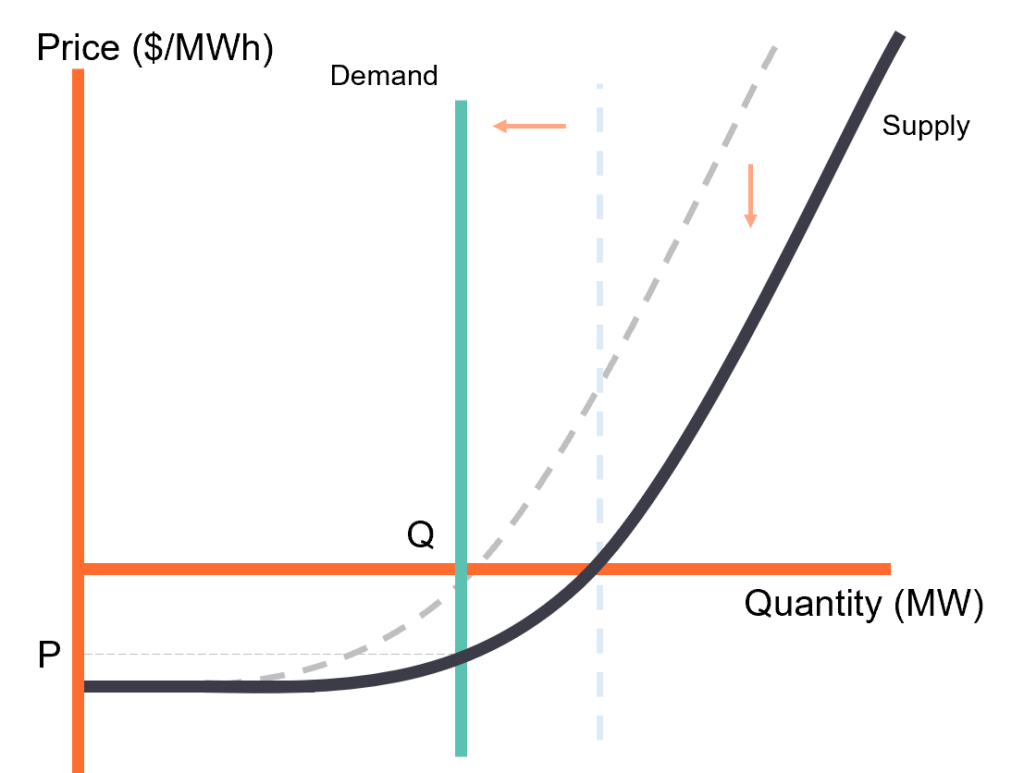

However, with much more renewables connecting to the system, we’re seeing more instances of the marginal generation offer being a negative price, causing the wholesale price to be negative. This happens both because of reduced demand (driven in large part by more rooftop PV), and generators offering electricity at negative prices (explained below).

The result is a negative price which means generators pay to generate electricity, and consumers are paid to take electricity. While this sounds bizarre, it is an important feature of the NEM. Negative prices signal times where there is too much energy being generated, This has two effects – they discourage generators from producing energy and encourage consumers to use more energy, helping to balance supply and demand.

Why do generators offer to generate at electricity prices and why do they just stop generating when the price goes negative?

There are three main reasons why generators would offer electricity at negative prices and why they keep generating when the price falls below zero:

- There are generators that cannot be easily or quickly turned off.. For some generators, particularly coal-fired power stations, turning off and turning on is a slow, expensive process. To avoid being turned off, they offer some of their power at very negative prices, giving them a high likelihood of having some energy dispatched and avoid shutting off the plant.

- Generators can earn supplemental revenue streams that still allow them to profit while selling energy at negative prices. For example, renewable generators get renewable energy certificates for every MWh produced. The revenue earned from these certificates can be enough to more than offset the negative wholesale prices, encouraging these generators to continue generating through negative prices.

- Lastly, generators can be indifferent to the wholesale price. Some generators have fixed the price of their generation by selling hedges or signing offtake agreements that mean they get a fixed payment per MWh regardless of the wholesale price. This means these generators are happy to produce at any wholesale price, including negative prices.

Most energy customers don’t actually get paid when negative prices occur because they’re on fixed price contracts but, as we explain later, negative prices present great opportunities for Flow Power customers!

How often do negative prices occur?

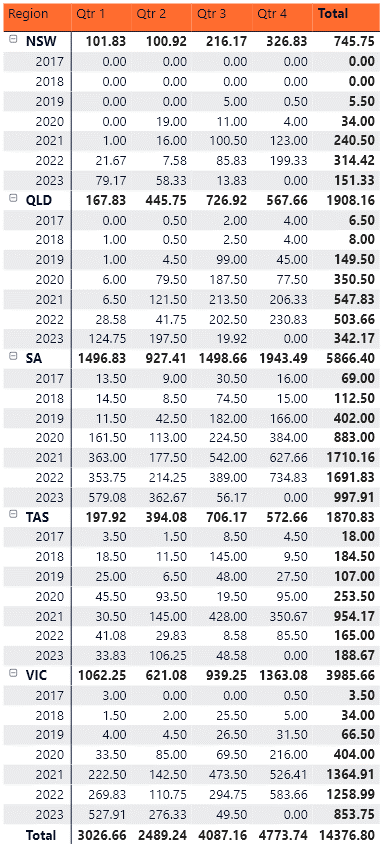

Negative prices have previously been regarded as somewhat of a peculiarity. However, they’ve become a regular fixture over the past few years. For example, the wholesale price in Victoria has been negative for almost 4,000 hours since the start of 2017.

The below table shows the increasing frequency of negative prices, although this slowed down in 2022, where spot prices were strongly impacted by the global volatility following Russia’s invasion of Ukraine. The table is up to date at 10 July 2023, hence why the numbers for Q3 2024 are lower than previous years.

Historically, South Australia has had most of the negative prices; however, they are now a common occurrence across the entire National Electricity Market.

When is the price going negative?

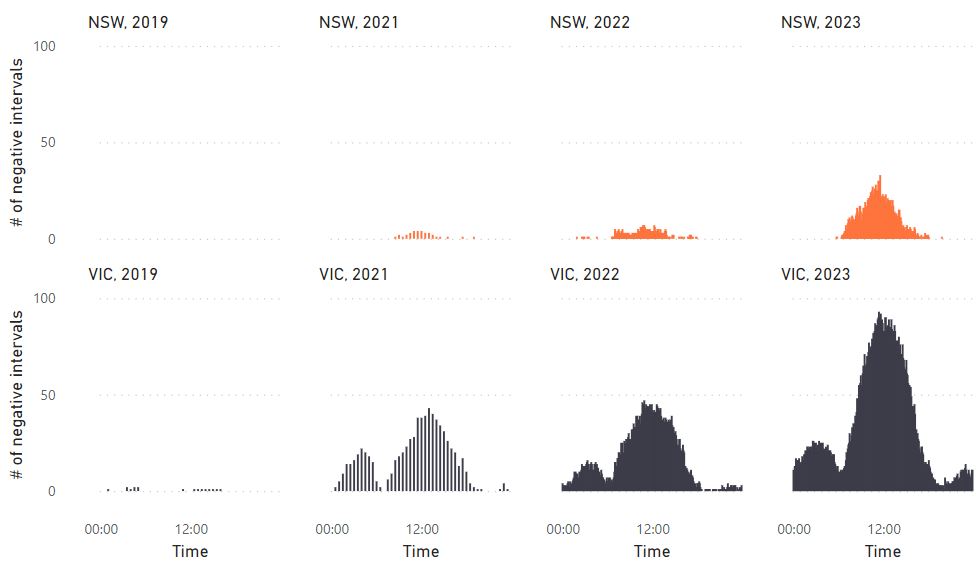

Negative prices are occurring primarily during business hours – this generally corresponds with lots of renewable generation, a large driver of low prices.

If we compare the first and second quarters over the years in New South Wales and Victoria, we can see how negative prices have increased from rarity to the norm. It’s also clear that the negative prices congregate around the sunlight hours and the early morning, but are much less likely to occur in the morning and evening peaks.

From the perspective of an energy customer, the increasing frequency on negative prices means it’s going to be something you encounter more and more often. Indeed, the negative prices have had a material impact on wholesale prices!

What are the impacts on overall prices?

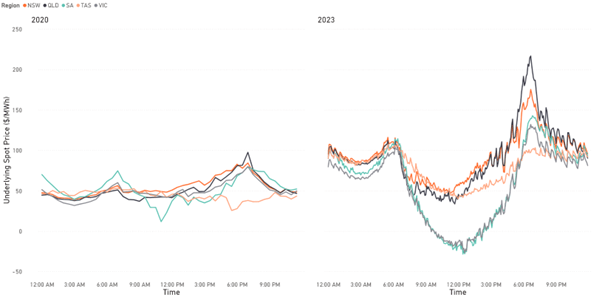

The negative prices are becoming so significant that they pushing the time weighted average monthly price lower and lower. At the same time, the morning and evening peaks of price are becoming more pronounced – this extenuates the price difference between those high-renewable periods with low or negative prices, and peak periods where prices are much higher.

Comparing the average wholesale prices between 2020 and 2023, we can see the impact of more frequent negative prices. The dynamics that cause negative prices (mostly continued growth of renewable energy) have driven more intraday price difference between peaks and troughs. While spot prices are higher than they were in 2020, average spot prices in South Australia and Victoria fell close to, or below zero in the middle of the day. All states have seen the wholesale price in the middle of the day hollowing out.

What does all this mean for Flow Power customers?

The growing trend of low or negative prices is a fantastic opportunity for customers to use flexible demand to lower their bills. Retail customers who have fixed price contracts won’t see the direct effects of negative prices flowing through to their bill.

However, all Flow Power customers can decrease their bill by being more price efficient. This means that, by moving energy demand from high priced periods to negative prices, Flow Power customers can both avoid high prices and get paid for using electricity.

Flow Power’s team can also equip customers to make demand flexibility easier.

By installing our kWatch intelligent controller, we’ll automate your operations so you don’t have to flick the switch. You’ll always have control on whether or not you’ll power down. You can respond to high or low prices by managing your energy usage.

The kWatch intelligent controller provides you:

- transparency and control over your energy use

- a live view into your energy demand

- the right information at the right time

Any questions? We’re here to help.

If you’re interested in learning more about how your business could potentially benefit from demand response, our friendly team are always available for a chat.

If you’re an existing Flow Power customer, please do not hesitate to reach out to your account manager.

If you’re not a Flow Power customer, please contact:

1300 08 06 08 (within business hours)

Live chat (within business hours via the chat button at the bottom of your screen)

Alternatively, you can submit your questions through our website contact form here.