The return of various offline units throughout July resulted in a decrease in the number of price spike events (where trading price goes above $500/MWh) in the three southern regions of the NEM.

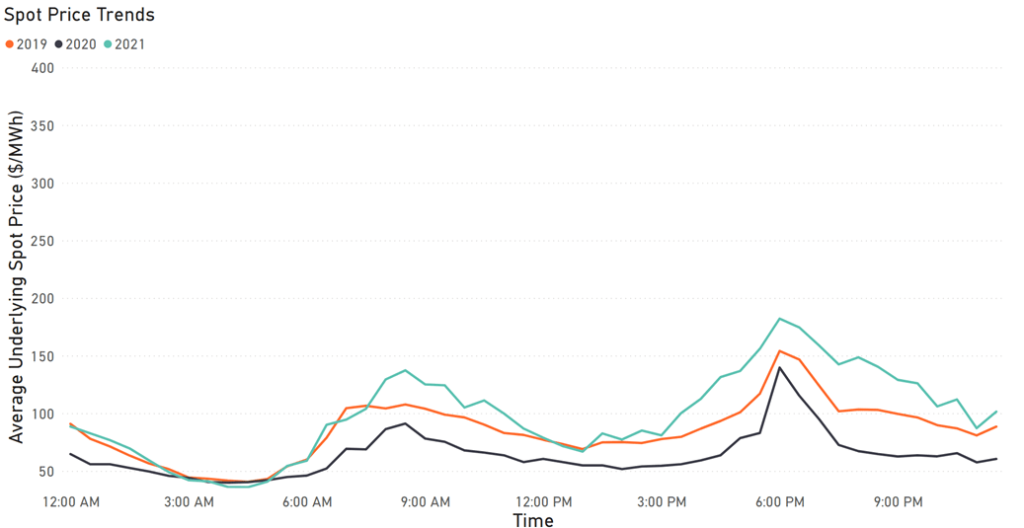

Offline generators in Queensland caused some price volatility, however the return of the Callide-3 Generator (which had been offline since May) appears to have brought back some stability. While volatility (the occurrences of >$500MWh prices) has decreased since June, average underlying spot price has continued to increase in all regions – this could potentially have been caused by higher gas prices NEM-wide throughout the month.

On the other end of the spectrum, the NEM saw new wind generation records, which resulted in lower (and even negative) prices in some places. This was especially prevalent in South Australia, where renewables were able to power the grid entirely (and cause negative electricity prices) for hours at a time during the month.

Let’s have a look at the unique trends across each state

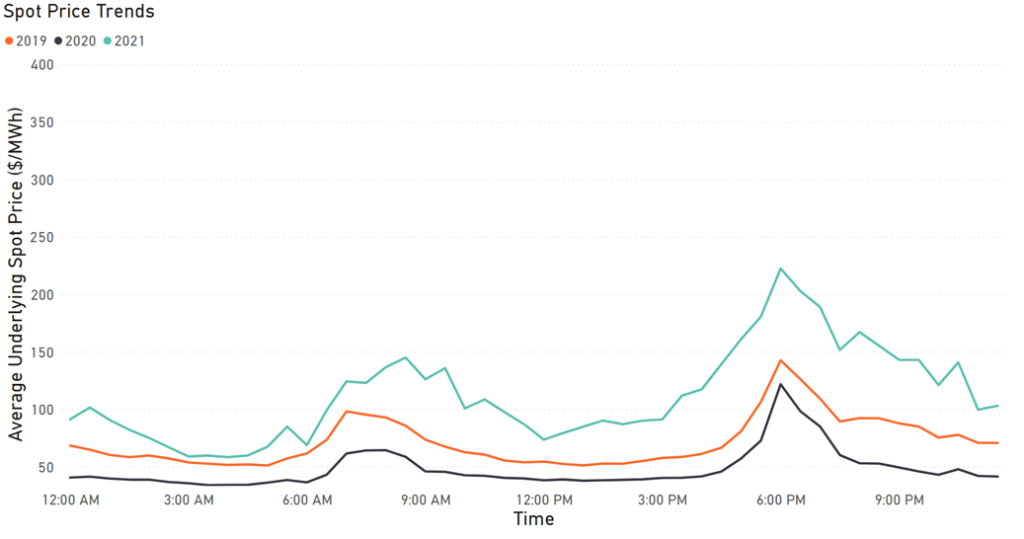

New South Wales

- Higher demand across the board, and lower availability compared to previous years (due to outages and interconnector constraints)

- Fewer high price events, but generally higher underlying spot price

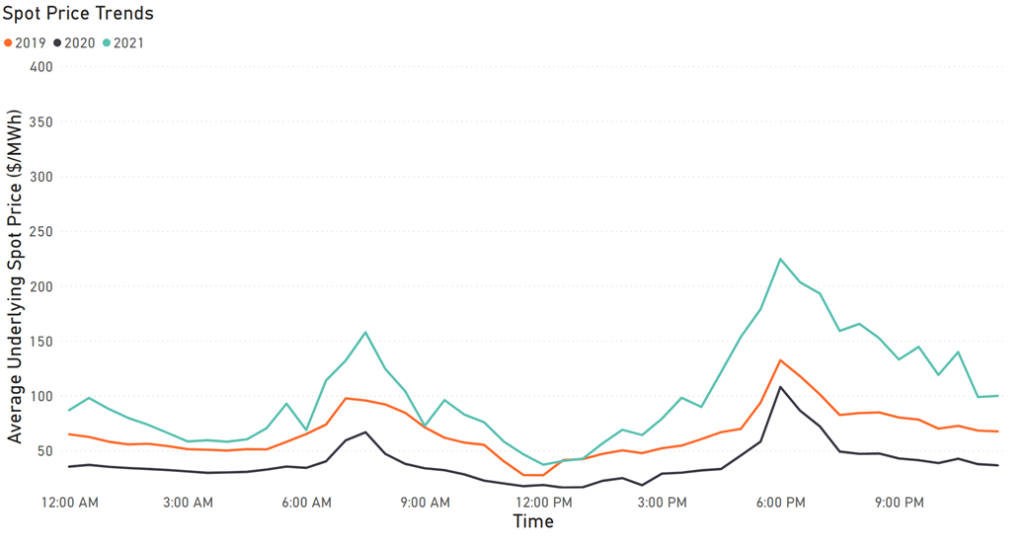

Queensland

- The trend over the past few months of higher peak demand (in the morning and evening) along with lower availability (due to outages) continued in July

- While there were fewer “price spike” events, the underlying spot price remained high

- Callide 3 returning on the 26th of July brought back ~400MW of availability into the QLD region, thereby reducing volatility

South Australia

- Higher middle-of-the-day and evening demand than previous years

- On days with high wind, electricity prices went negative for hours at a time, and AEMO had to intervene and turn off some renewable generators to preserve network stability

- When the new SA/NSW interconnector is built in 2028, it is expected that SA could export this excess energy when it is available, and have the additional support of NSW thermal generators when it isn’t, reducing costs in both regions.

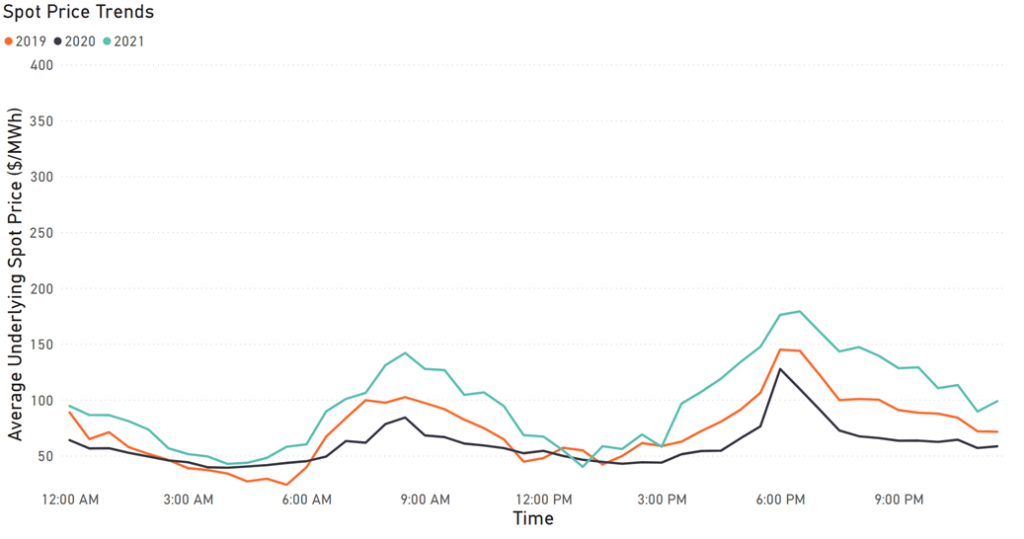

Victoria

- Higher demand at all times compared to previous years, though this came hand in hand with higher availability (reducing the effect on price spikes compared to other regions)

- Similar to other regions, fewer price spikes but higher overall underlying spot price

The energy price trends for July and what we’re expecting in August

To summarise, the trend of the past two months (higher demand and lower availability) has continued in NSW and QLD throughout July, though the return of baseload generators towards the end of the month should alleviate the pressure on the system.

Interestingly, volatility has decreased in these two higher-volatility regions, indicated by the lower capped price. However, underlying spot price has increased across all regions. This means that while we see less of these “high price” periods where spot price goes into the thousands, the underlying spot price has generally been higher. One potential reason for these higher base costs could be the higher price of gas in July (along with annual winter demand).

Looking forward, monthly contract prices for August across the NEM are looking lower than those for July, indicating a general market sentiment of softer prices in the next month. This should be supported by the return of baseload generators through July and August resulting in higher availability, in addition to the decreasing demand as we move out of winter.

If you want a more detailed understanding of what happened in the energy market last month, read our Market Wrap for June 2021.

Any questions? Our energy specialists are here to help.

If you’re an existing Flow Power customer, please do not hesitate to reach out to your account manager.

If you’re not a Flow Power customer, feel free to contact our friendly team:

? 1300 08 06 08 (within business hours)

?️ Live chat message (within business hours via the chat button at the bottom of your screen)

Alternatively, you can submit your questions through our website contact form here.