It has been an interesting June, with almost two different price markets in each half of the month. Prices remained high in the first half (including a fair few high price events) with no changes in market conditions from late May. However, a number of baseload generators returned to service in Mid-June, which reduced volatility overnight.

The storms in Victoria on the 9th and 10th of June had a devastating impact on many families in the Dandenong Ranges, with some residents still without power. They also affected the Yallourn Power Station, which in turn impacted power prices across Victoria (and to an extent, South Australia and New South Wales).

Let’s have a look at the unique trends across each state

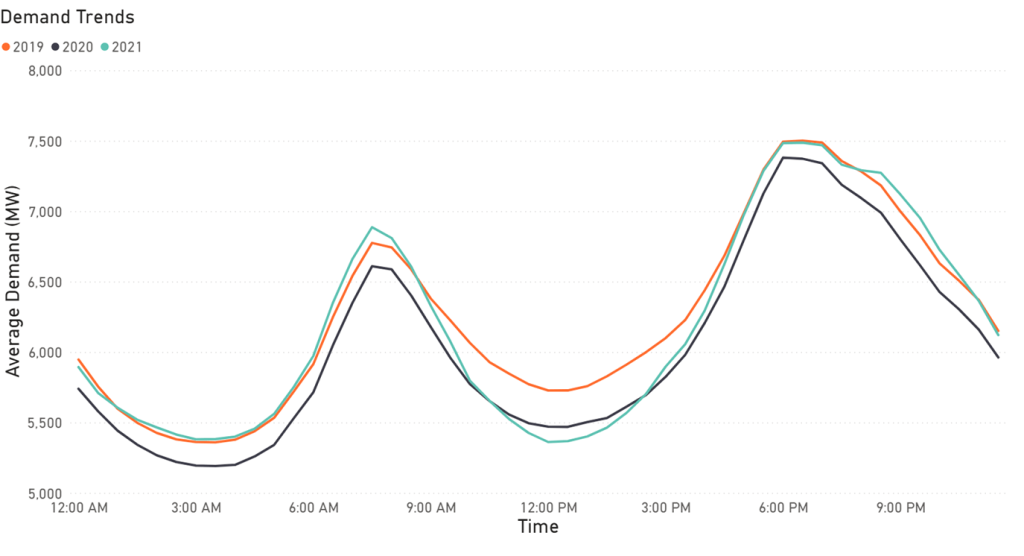

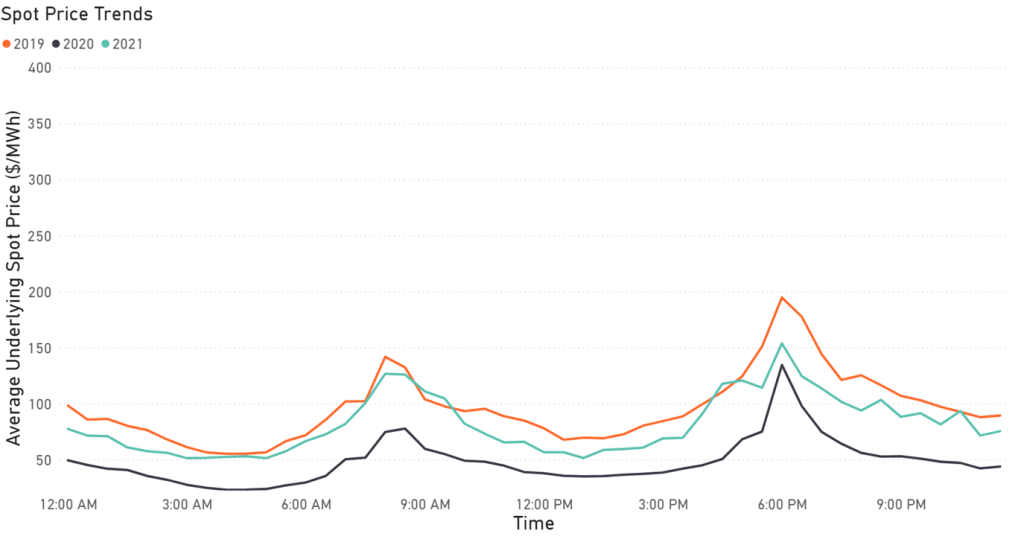

New South Wales

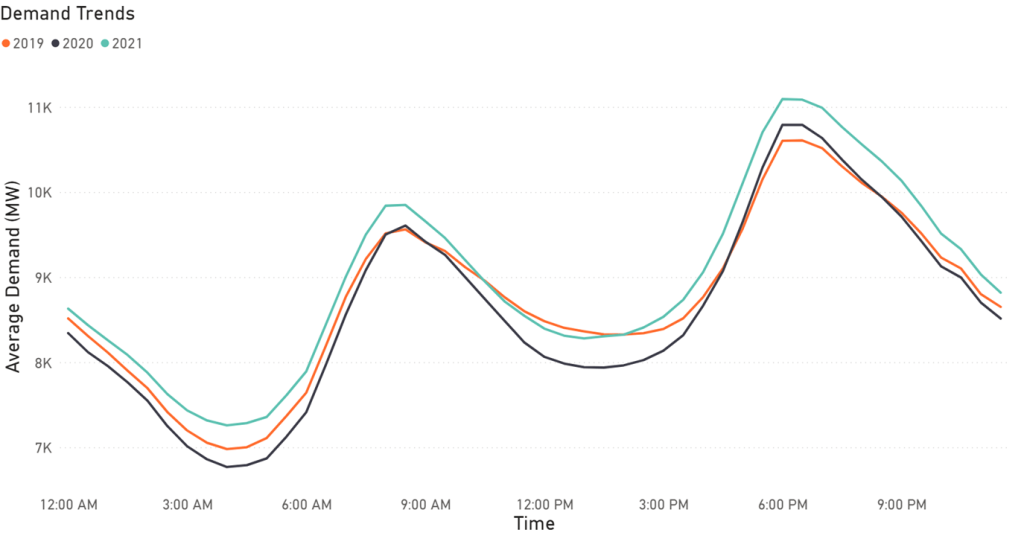

- As in May, demand was higher than previous years in New South Wales, and even reached a peak demand of around 13GW – this hasn’t been recorded in any winter since 2010

- Supply remained limited, with some units still offline for regular maintenance, and Liddell 2 still offline due to a trip in May

- Continued volatility due to lower than expected supply and higher demand resulted in a number of “high price” events in the first half of June, though this price behaviour subsided in the second half with a number of units returning to service

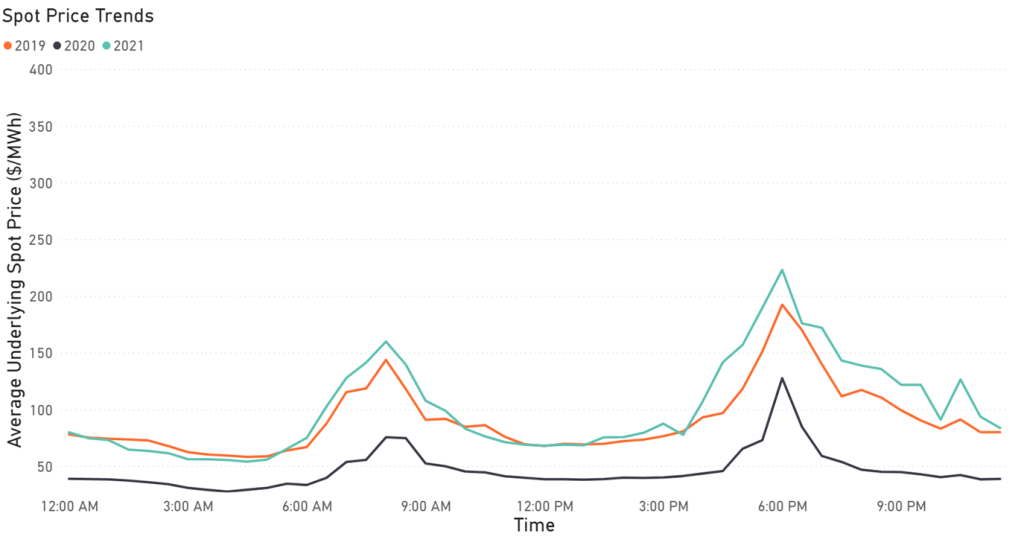

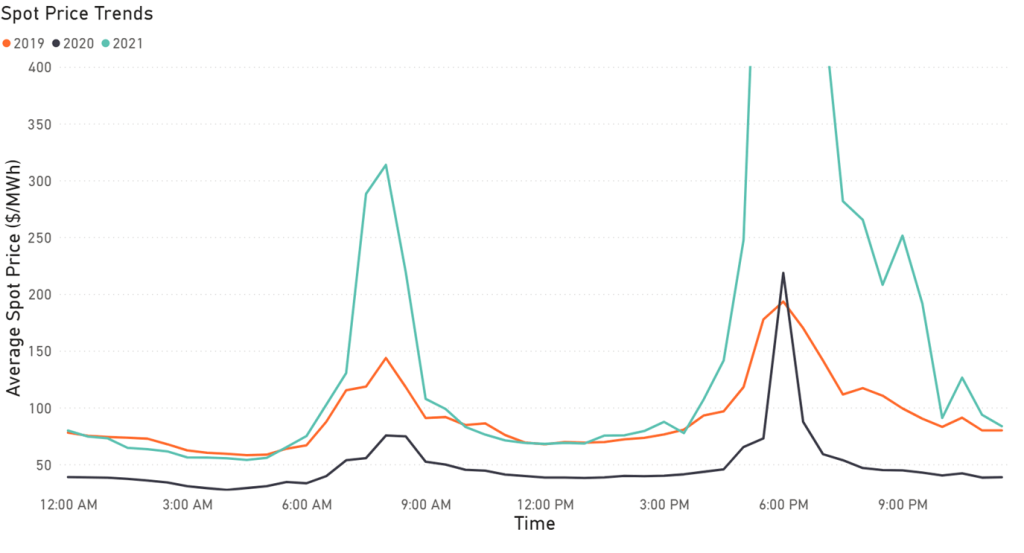

- While spot price was higher than in May, this was not purely due to “spike” events – underlying spot was still as high as it has been since the start of 2020

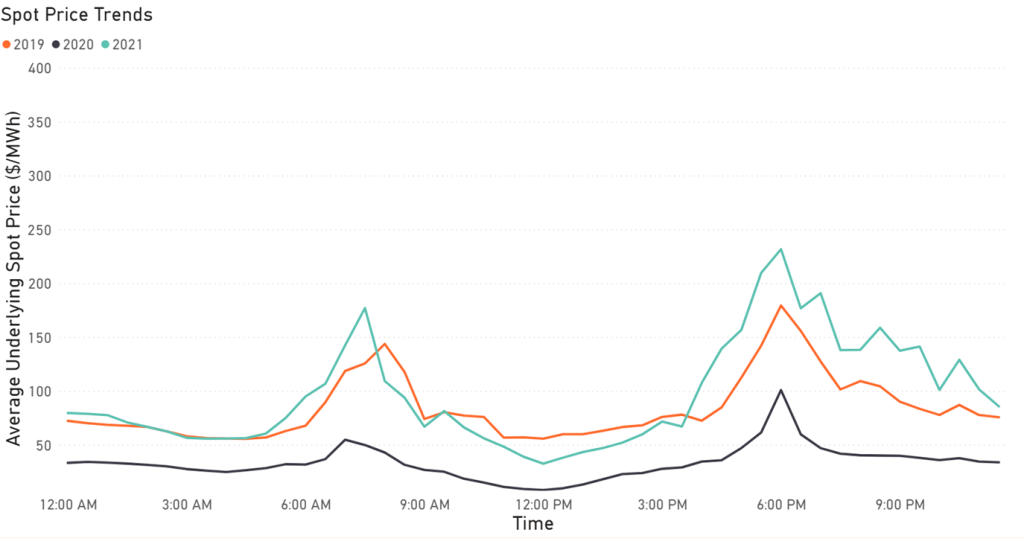

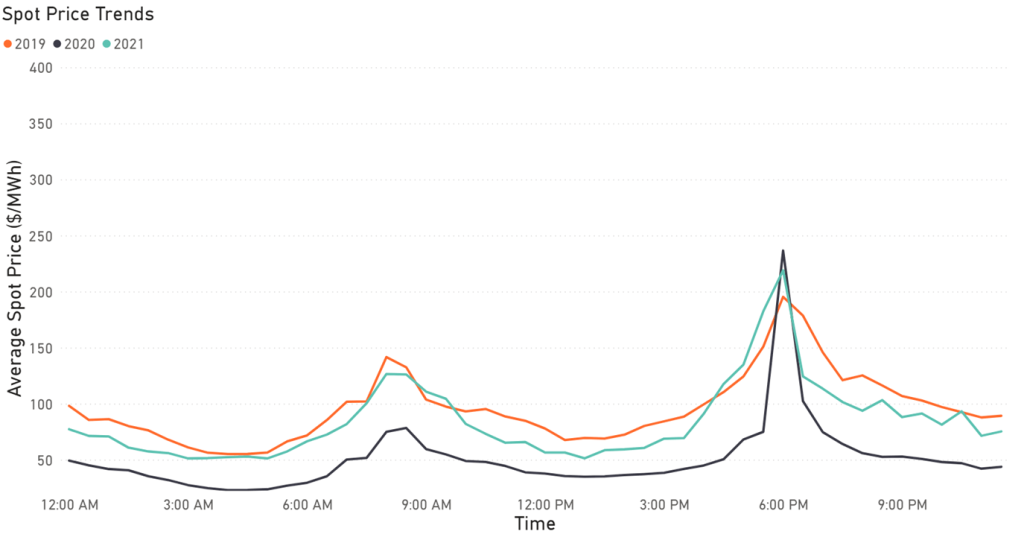

Queensland

- A volatile first half of the month due to continuing factors of lower supply and higher demand in the first half of June

- This resulted in higher average underlying spot prices across the board, especially during peak demand times in the mornings and evenings, and a number of high price spike events

- The return of the Callide B1 and Kogan Creek generators on the 17th of June, and Callide B2 on the 22nd of June increased baseload supply in Queensland by around 1400MW, which decreased pressure on the system and led to fewer high price events

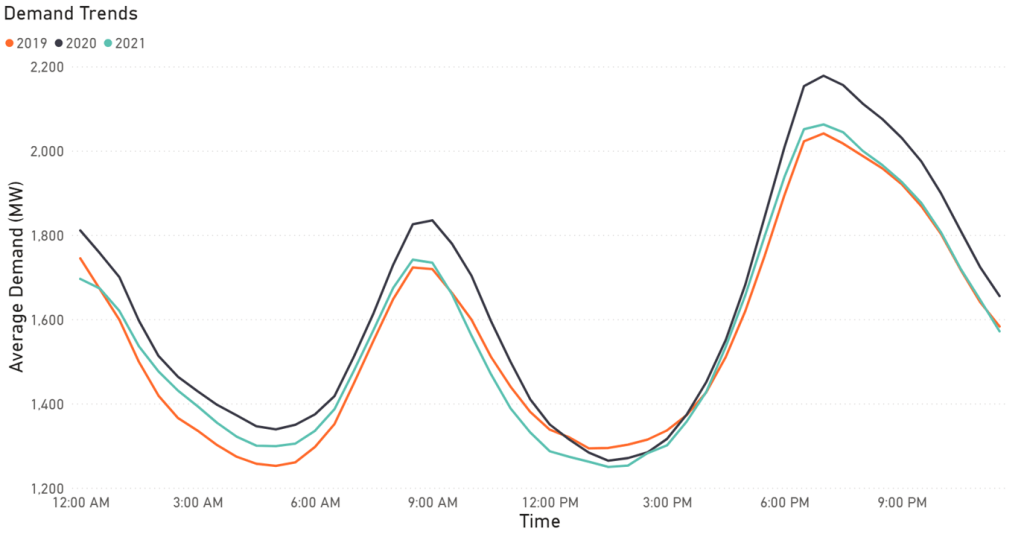

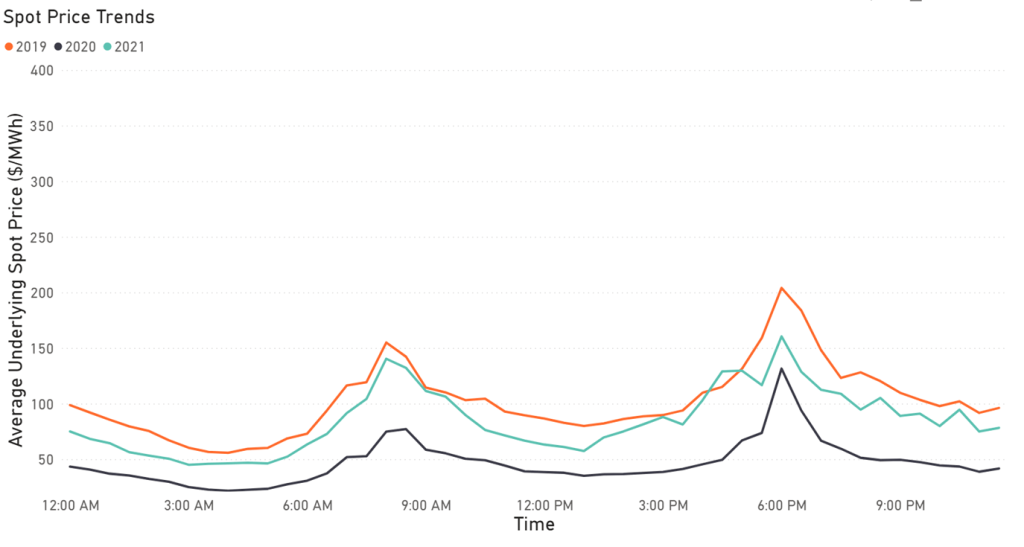

South Australia

- Demand in SA continues to trend downwards, with average demand being lower at all times compared to 2020

- Similarly, supply was lower, which contributed to higher underlying spot prices

- Pricing in SA continued the trend seen in May, with lower underlying spot prices in the first quarter of 2021 contributing to higher prices in June

- Lower-than-expected Rooftop Solar in June (with average generation lower than 2020) contributing to higher demand, and therefore higher prices

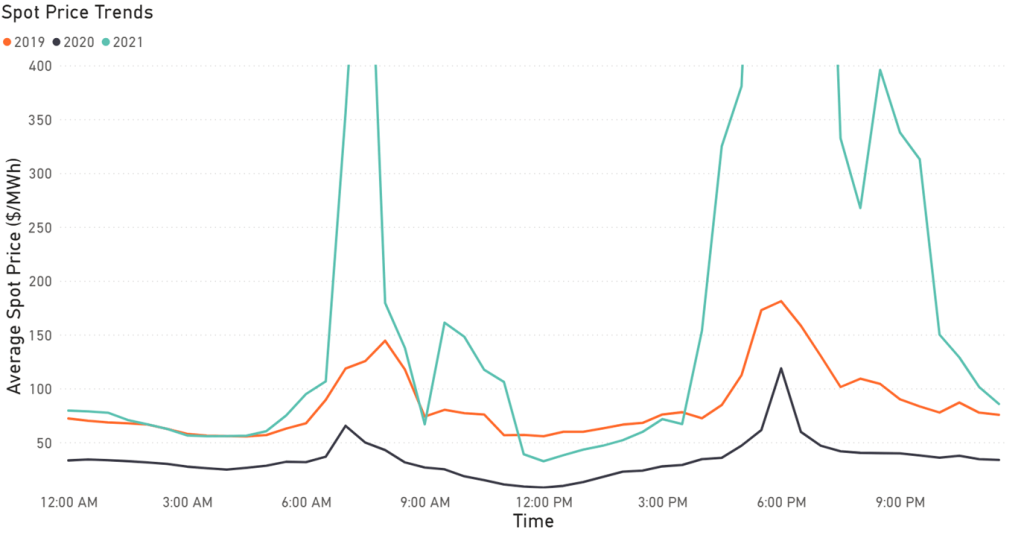

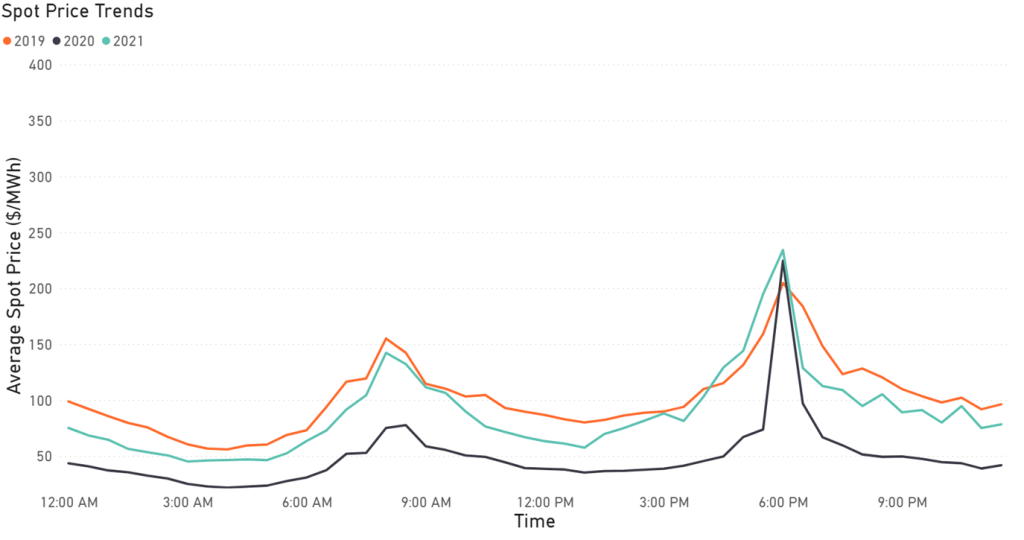

Victoria

- The storms in Victoria disrupted output at the Yallourn power station, which provides around 20% of Victoria’s electricity. This resulted in some higher volatility in the Victorian electricity market

- While one unit of Yallourn has returned, that single unit is still not generating at full capacity. The other units are expected to return at the start of July, however supply issues (due to risks the Yallourn mine could be flooded after cracks were found in the wall of a nearby river diversion) may persist for months, resulting in lower generation

- Demand was similar to previous years, with supply not decreasing too much (despite Yallourn going down). Yallourn (as a coal generator with less ability to reduce output) often offered power at lower prices to other types of thermal generators, so while supply hasn’t seen a drop off, prices can still be heavily affected

- While there were fewer spikes (indicated by the lower cap payout), the average underlying spot price was still higher in June than in May, most likely caused by the loss of Yallourn.

The energy price trends for June and what we’re expecting in July

Looking back on the past month, we have seen similar price behaviour from the latter half of May continuing throughout the first half of June. This is because until mid-June (when a number of baseload generators returned to service), the market conditions didn’t really change – there was higher demand across the NEM, and lower supply.

While this resulted in multiple high price events earlier in the month (especially in NSW and QLD where many major outages happened), it also caused a general slight increase in underlying spot prices. This meant that even if you used power at its cheapest points throughout the day, you still paid more than you were earlier in the year (as base prices were higher). As expected, the return of generators in mid-June alleviated some of the pressure on the system, and reduced volatility – we saw fewer high-price events in the last two weeks of June.

In July, the return of some Yallourn generators (albeit at reduced capacity) and other baseload generators in NSW and QLD should result in reduced pressure on the system, and lower prices as a result. This will likely be accompanied by higher demand though, as is common in the July due to colder temperatures.

Looking at forward monthly contract prices, we would expect prices in July to settle significantly compared to May and June – while contract prices for VIC and SA in July have increased since the Yallourn flooding incident, they are still looking softer than prices this month.

If you want a more detailed understanding of what happened in the energy market last month, read our Market Wrap for May 2021.

Any questions? Our energy specialists are here to help.

If you’re an existing Flow Power customer, please do not hesitate to reach out to your account manager.

If you’re not a Flow Power customer, feel free to contact our friendly team:

? 1300 08 06 08 (within business hours)

?️ Live chat message (within business hours via the chat button at the bottom of your screen)

Alternatively, you can submit your questions through our website contact form here.