On the 22nd of May (2019), we held a webinar to discuss how timing impacts energy contract prices and how we overcome the timing risk with Power Active.

When it comes to the cost of energy, there is a range of factors that impact the market price. From supply and demand to weather, policy, regulation, and timing, these make the market hard to predict.

While Power Active gives the same visibility over pricing as a standard fixed-rate contract, it has two tools, the Active Option and Price Efficiency Adjustment (PEA), that offer more flexibility than most retail contracts.

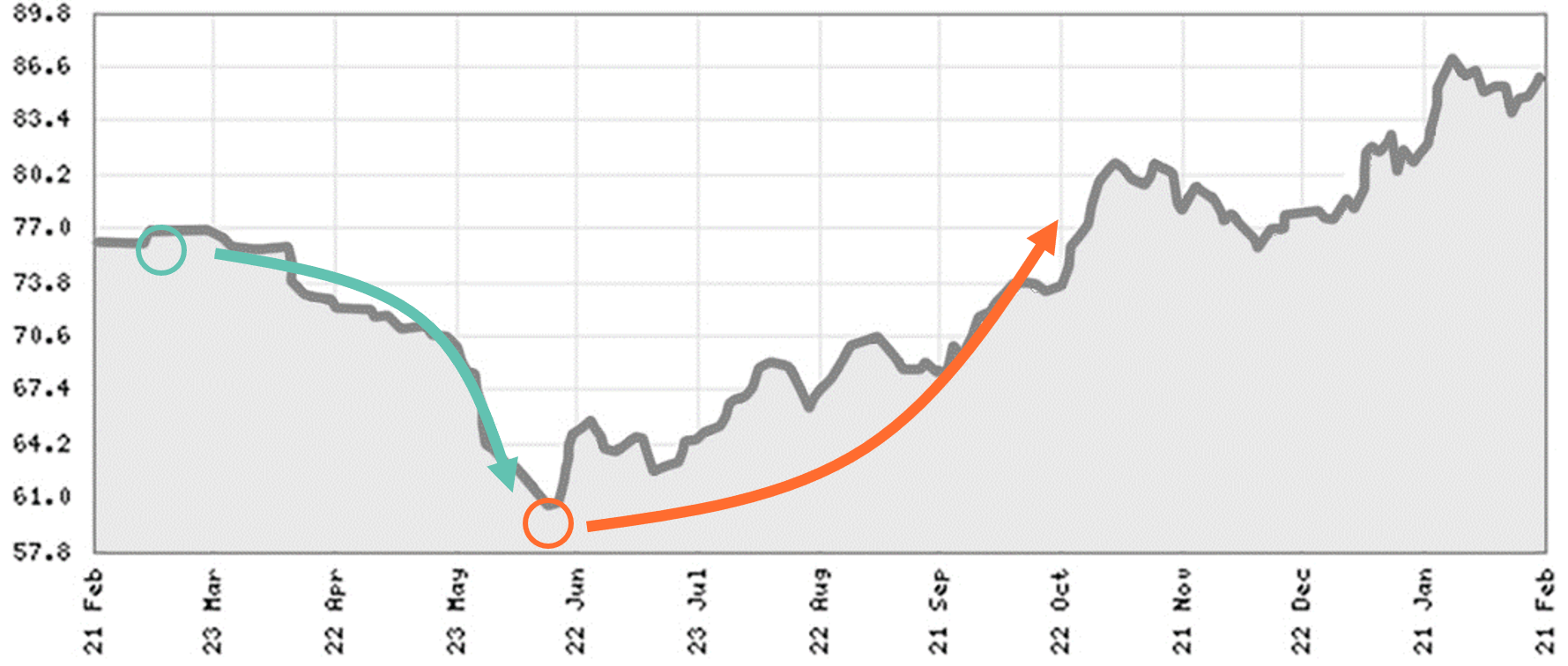

In a market where prices can – and do – drop these tools are key. Just take a look at the historical prices from the ASX Futures, pictured below.

*Chart courtesy of ASX Energy Futures, 07 December 2018

Tools for better prices

Power Active lets businesses move with market rates if they drop through the Active Option. That means, no matter where the market is at when a business signs its contract, it has the chance to move to lower rates if the market falls.

Each month, the PEA allows businesses to positively influence their monthly prices. The PEA is a measure of how price efficient a business is compared to the market. It rewards business for how and when they use power, delivering greater savings when a business can be price efficient.

Each month, billed rates are set by multiplying an agreed contract rate against the PEA and adding the retail margin, as well as the access fee of the Active Option.

Becoming active

In 2017 Daniel, an operations manager for a New South Wales-based business, was nearing the end of his energy agreement. Energy prices were at a high, impacting the offers Daniel was receiving from other retailers. He knew it was likely that rates would drop in the future.

So, he looked for an alternative. Unlike other retail offers, Power Active could offer him greater flexibility and would let him lock in a lower rate if the market fell.

Daniel’s business chose to add the Active Option in both years of its two-year Power Active plan. While he paid a higher access fee to add the Active Option in the first year, it was an easy decision to make due to the unusually high market rates. This would allow the business to move to a lower rate if the market fell before the contract began.

And it did.

By late 2017, the rates for the financial year 2018 dropped by five percent. Consequently, the Active Option moved the business directly onto the lower rate, which delivered savings of two percent after the Active Option access fee was deducted.

At the same time the following year, market rates had fallen again, securing an 18 percent lower rate for the financial year 2019.

Once Daniel saw the business’ savings, he re-contracted early for FY20. To date, locking in his agreement early has protected the business against a 20 percent increase in rates.

Things to take away

Power Active gives businesses two tools that no other retail offer will: the Active Option and PEA.

Both tools work to eliminate the timing risk that businesses can experience when they go to market for new energy contracts. Where the Active Option lets businesses move alongside falling market rates, the PEA rewards them monthly if they can operate price efficiently, by making the most of off-peak hours in the market.

For businesses looking for energy, with opportunities to take back control over prices, Power Active is the perfect solution.

Q&A

In the case study, you said the business contracted early for the third year. What is the benefit of having a rolling contract?

A rolling Power Active contract ties in relatively nicely with liquidity in both the ASX market and the options market, where we undertake some hedging in the background. As a business rolls into the year of delivery, we would begin looking at the third year or fourth year as you go. This would be one way to continue to hedge long-term and not take on the risk around markets continuing to rise and move against you.

It is logical to continue extending the Active Option as far out as you can. This gives long term protection against the possible outcome in two or three years time. If you usually sign up to that third-year rate it’s often lower than today’s market.

What is the access fee for the Active Option?

The access fee depends on the market at the time. It usually varies somewhere between 0.4 of a cent up to 0.8 of a cent a kilowatt-hour, which is a relatively small percentage of the ASX price.

Do I get an additional benefit if I put solar on my roof from this plan?

Historically yes, you would not only pay less in terms of the volume of energy, but you would have paid less in the energy rate. However, as the market shape changes, businesses will incur relatively minor impacts.

A major thing to consider in your solar strategy is your energy efficiency and how you are using your power as well.

What if I sign onto Power Active but sign a Power Purchase Agreement later?

There is flexibility, particularly in later years with rolling strategies to consider not only the ASX but also potentially wind and solar from a Power Purchase Agreement (PPA) to meet some or a portion of your load. These decisions to sign up for five to ten years can take longer to get across the line in businesses, therefore you may not be in a position to sign one immediately, though it is certainly something we can weave in with Power Active.

How long do I need to sign a Power Active agreement for? Is it best to sign two, three or five years?

The maximum term is three to four years, however, it can be altered should businesses choose to look at longer terms.

Is there still a peak and off-peak rate on this plan?

Yes, there is. Power Active offers both peak and off-peak pricing but allows customers to influence these rates by improving their PEA. Flow Power’s peak pricing is a little different.

Flow Power’s pricing is always based on the wholesale contracts peak 7 am to 10 pm AEST on working days. This is compared to the market peak price, which is 7:00am-11:00pm in VIC and QLD, 7:00am-10:00pm in NSW and 7:00am-9:00pm in SA. When compared to other offers, a Flow Power offer will have ~ five less peak hours per week.

Power Active locks in the market rate at the time of signing the deal. Price drops in the market and taking control of your PEA will lead to further reductions in the price you pay for your energy. The price security of this deal, particularly with the Active Option, means that peak and off-peak no longer become a factor that businesses need to actively monitor.

Is Power Active just a fixed rate that moves?

Not exactly. Power Active can give you a predictable rate for the lifetime of your agreement with us.

This means that you will get a rate that you can compare with any traditional fixed-rate offers that you receive, and you can budget for the future.

Can I use the Active Option at any time over the period of my contract?

Normally, the Active Option would apply to the second year but in some circumstances, such as where there are unusually high market conditions, businesses can make the decision to pay a small premium and apply the Active Option to the first year too.

Would it just be better to sign a contract every winter when prices are typically lower?

Businesses can sign Power Active at any point in the year. Through the Active Option, Flow Power take the stress of monitoring the market on a daily or a week-to-week basis for the business.

Any questions? We’re here to help.

If you’re interested in learning more about the wholesale demand response mechanism, our friendly team are always available for a chat.

If you’re an existing Flow Power customer, please do not hesitate to reach out to your account manager.

If you’re not a Flow Power customer contact our friendly team today:

? 1300 08 06 08 (within business hours)

?️ Live chat message (within business hours via the chat button at the bottom of your screen)

Alternatively, you can submit your questions through our website contact form here.